Commentaries /

2022 Q4 Canadian GDP: A GDP miss will raise recession fears

2022 Q4 Canadian GDP: A GDP miss will raise recession fears

The flat GDP growth for the fourth quarter of 2022 is worse than expected, and will have forecasters looking closer to time the start of a potential recession in Canada. The signals from the monthly data point to a strong showing in January, but make no mistake, the economy’s fundamentals are weakening and momentum is slowing as higher interest rates are beginning to bite.

Stephen Tapp

Today’s flat GDP growth for the fourth quarter is worse than expected, and will have forecasters looking closer to time the start of a potential recession in Canada. The signals from the monthly data point to a strong showing in January, but make no mistake, the economy’s fundamentals are weakening and momentum is slowing as higher interest rates are beginning to bite.

– Stephen Tapp, Chief Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

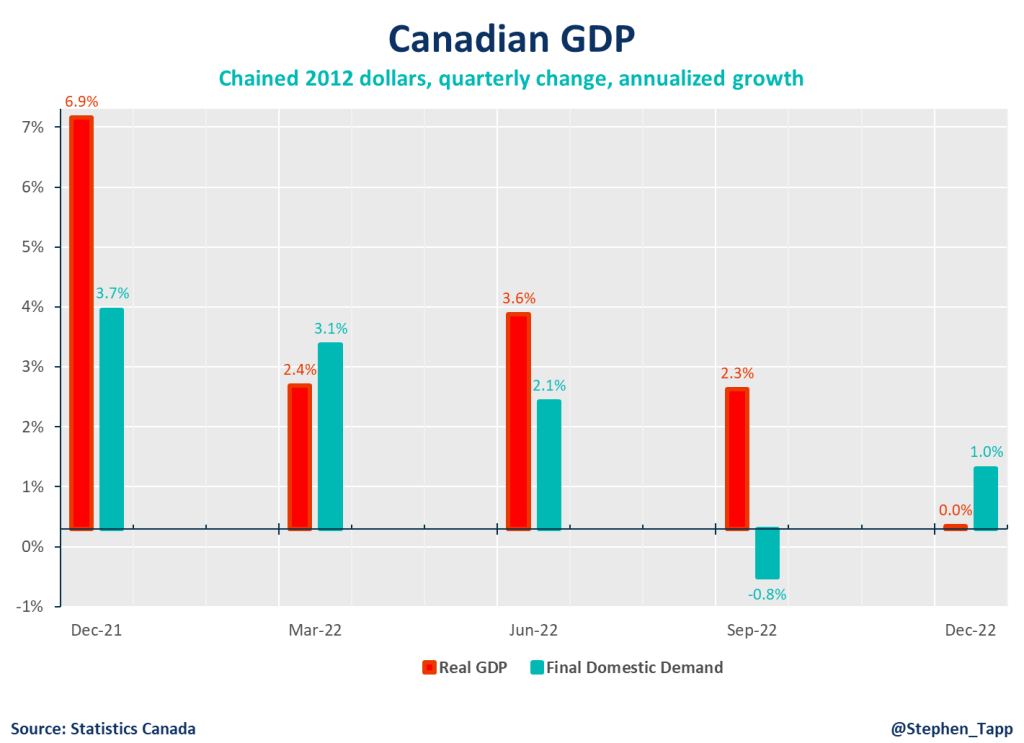

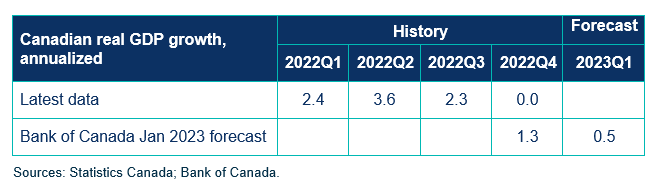

- Canada’s real gross domestic product (GDP) growth was flat (0.0% annualized) in the fourth quarter of 2022 — significantly under-performing market expectations (1.3%).

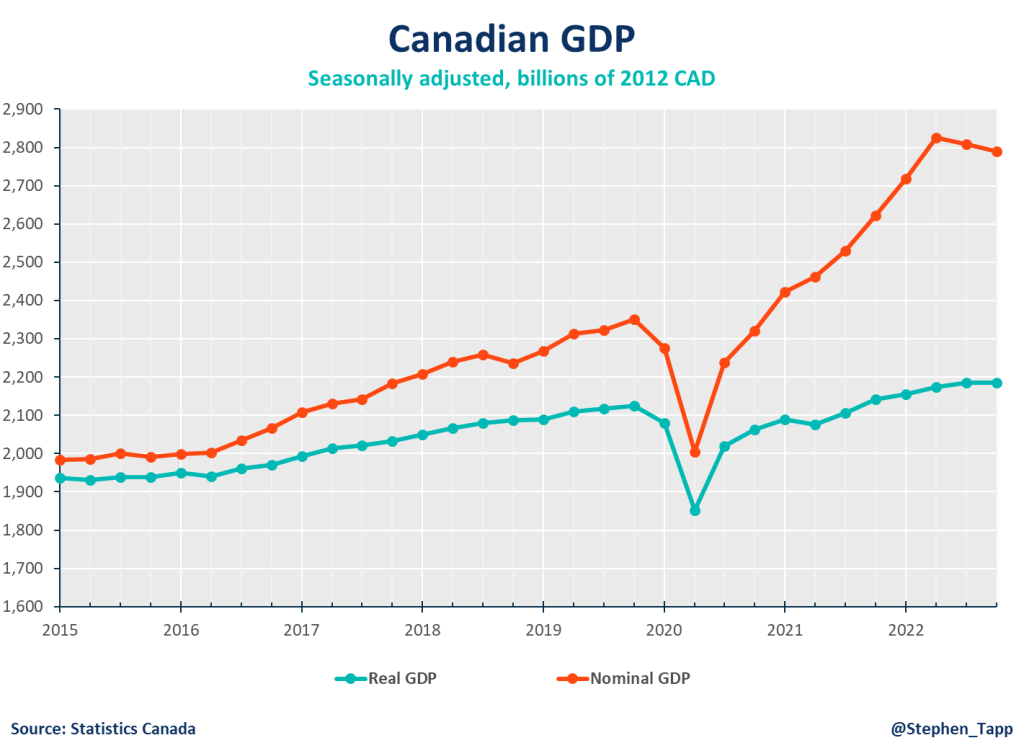

- For calendar year 2022, growth was 3.4%. This rate is slower than the 5% recorded in 2021 at the start of the pandemic economic rebound. Most forecasters expect the slowdown to continue into 2023, with growth of less than 1%.

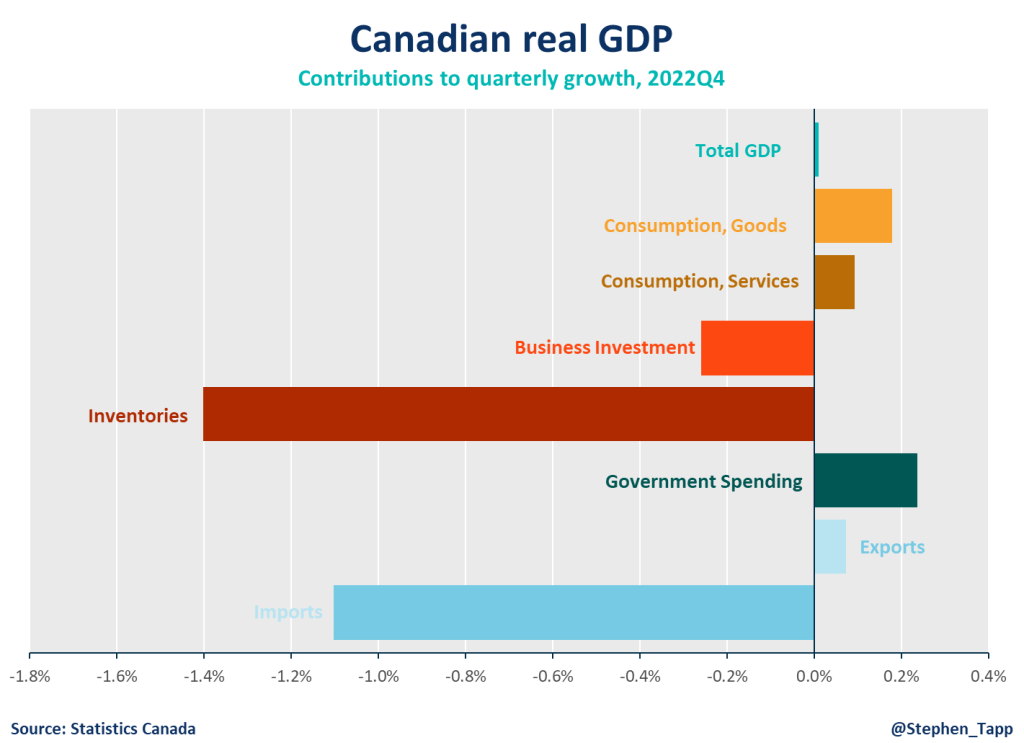

- Unlike last quarter, some details are marginally better than the headline figure. In Q3, a buildup of inventories and trade gain flattered headline GDP, but these factors reversed and hurt the headline number in Q4. This can be seen in the fact that final domestic demand rebounded (+1.0% in Q4, after falling 0.8% in Q3).

- Consumer spending bounced back (+2.0%, after falling -0.4% in Q3). With the easing of global supply chain problems, goods spending picked up on motor vehicles. Services spending was also positive, but growth slowed as consumers recover from previous spending-sprees following the easing of COVID restrictions. The household saving rate increased from 5.0% to 6.0%, as disposable income was padded by government benefits (a GST credit top-up and Old Age Security payments).

- It’s no surprise that sharply higher mortgage rates continue to deflate Canada’s housing market, which had boomed earlier in the pandemic. Residential investment fell for the third consecutive quarter (-9%).

- Business investment remains weak (-5%), and has also fallen for three straight quarters, amid higher borrowing costs and a weakening and uncertain sales outlook. Spending on machinery and equipment fell by 28% on the quarter.

- International trade: Exports edged up again (+1%) after strong third quarter, but imports were down sharply (-12%), which is not a good sign for business investment or future production.

- Nominal GDP, which had been doing very well due to rising prices, fell for the second straight quarter (-2.7% annualized in Q4, but +11% for 2022 overall). Canada’s terms of trade continue to fall due to lower energy prices.

- Today’s release also includes monthly details for GDP by industry, which shows -0.1% for December (worse than the flash estimate of +0.0%), and is partly attributable to adverse weather that constrained production in oil and gas, transportation and warehousing.

- Thankfully, StatCan’s flash estimate for January is a very strong +0.3% rebound, for a month that already had a monster Labour Force Survey featuring an impressive 150k employment gain, and rising hours worked (both +0.8% month-on-month). Assuming no further changes, 2023Q1 growth would be positive +1.0%.

- The Bank of Canada’s January forecast acknowledged that two quarters of slightly negative growth are about as likely as two quarters of slightly positive growth. In other words, the Bank continues to put ~50-50 odds on the likelihood of Canada’s economy experiencing a “technical recession” in the short-term.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022