Commentaries /

Budget 2024: Capital gains pains

Budget 2024: Capital gains pains

“Today, after weeks of pre-budget spending announcements on housing, defense, artificial intelligence and more, the government finally answered the questions of “how much will this all cost? And who’s going to pay for it?”.

Business Data Lab

“Today, after weeks of pre-budget spending announcements on housing, defense, artificial intelligence and more, the government finally answered the questions of “how much will this all cost? And who’s going to pay for it?”.

Budget 2024 puts the total bill for all new measures at $57 billion dollars over the projection period. It turns out that those with capital gains may feel more pain (as raising the inclusion rate is expected to bring in more than $19 billion over the projection). And while inflation may be hurting the government in the polls, it continues to provide some fiscal room to help offset new spending. The remainder of the bill falls to the government’s bottom line and the taxpayers’ tab, as the deficit is expected to be a cumulative $10 billion higher over the projection.”

KEY TAKEAWAYS

- Budget 2024 Context: Facing the highest inflation in a generation, central banks have aggressively raised interest rates to restrain demand. Inflation is slowing, although still not back to target, while the global economy has thankfully avoided a recession.

The U.S. economy continues to defy expectations. For its part, Canada’s economy has displayed resilience, but remains fundamentally fragile with strong population growth flattering headline numbers and reducing real GDP per capita.

Even with slower inflation, overshooting prices mean that affordability remains a central preoccupation for many consumers, especially younger Canadians.

Business bankruptcies have started to rise after emergency government programs ended, which had provided a pandemic pause.

Interest rates in Canada are expected to start coming down this summer, but with the strong U.S. economy, rates globally may stay higher-for-longer than markets have been expecting. - Some Economic Tailwinds: In this context, Canada’s private sector economists continue to see a soft landing, featuring modest growth as inflation slowly returns to Bank’s 2% target. And while inflation is clearly unpopular, and may be hurting the federal government in the polls, it continues to pay dividends for Ottawa’s bottom line.

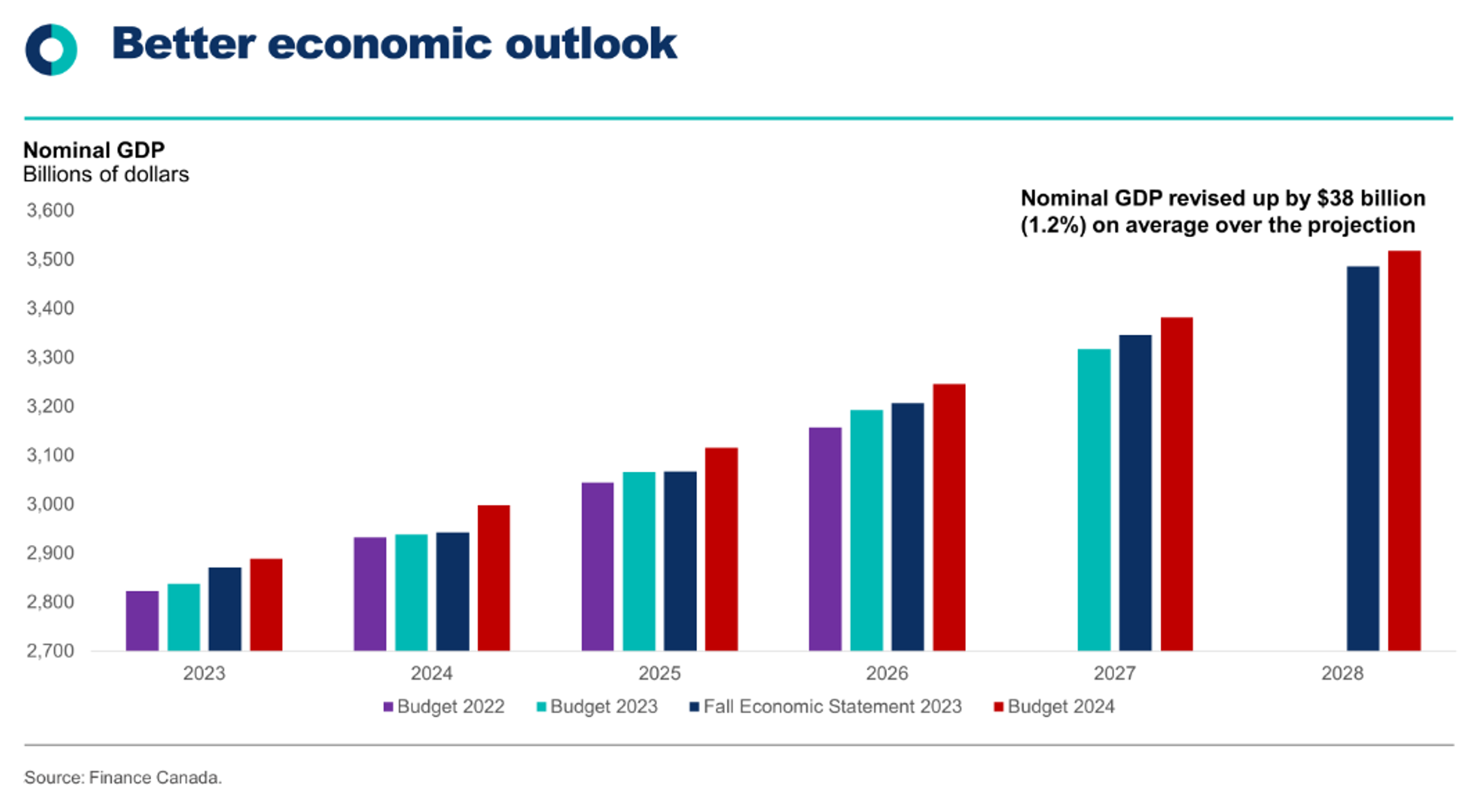

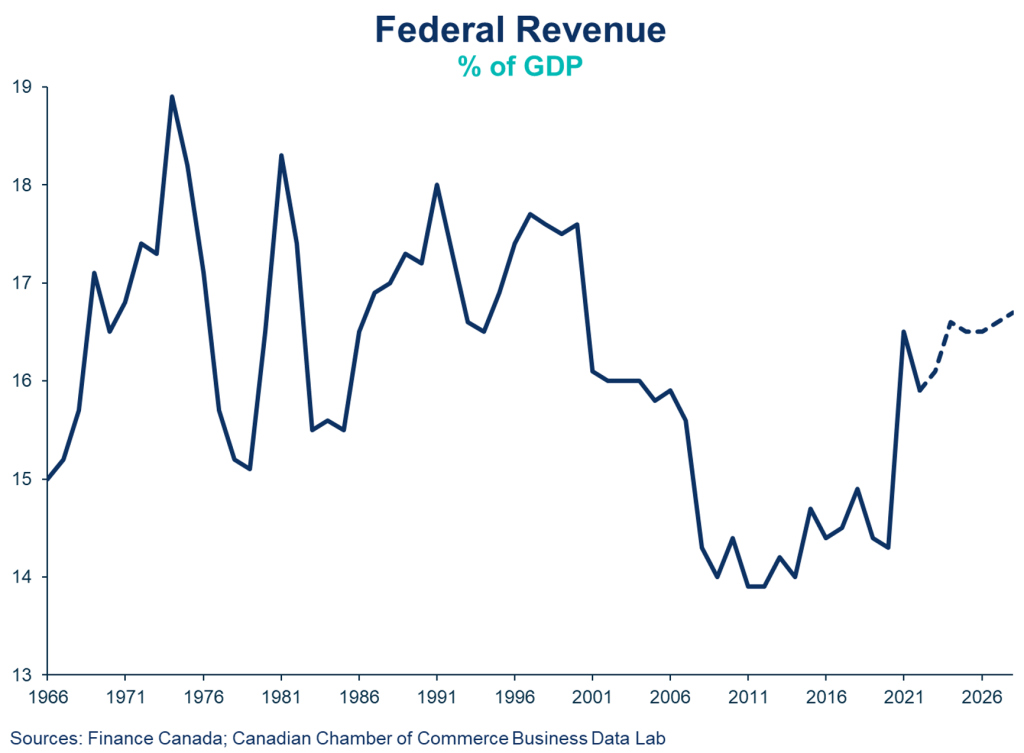

The private-sector economic forecast in Budget 2024 provides some fiscal room to help with policymakers’ recent spending announcements. The forecast not only incorporates better near-term economic growth prospects (which are unwound over the projection); but more consequentially, higher GDP inflation (a positive shock from 2023 carries forward into 2024 and isn’t unwound).

As a result, the path for nominal GDP — the broadest measure of the government’s tax base — is up nearly $40 billion (or 1.2% on average) over the projection.

The Budget suggests that the latest private-sector survey is reasonably cautious (as its weaker than several other notable organizations such as the Bank of Canada, PBO, OECD and IMF). They nonetheless include downside and upside scenarios. As a rough “stress-test” the books, Canada suffers a shallow recession in the downside scenario.

- New Policy Measures: In the recent weeks, the government rolled out a series of announcements on housing, defense spending, artificial intelligence and more. The big question that was answered today is “how much is all of this going to cost?”

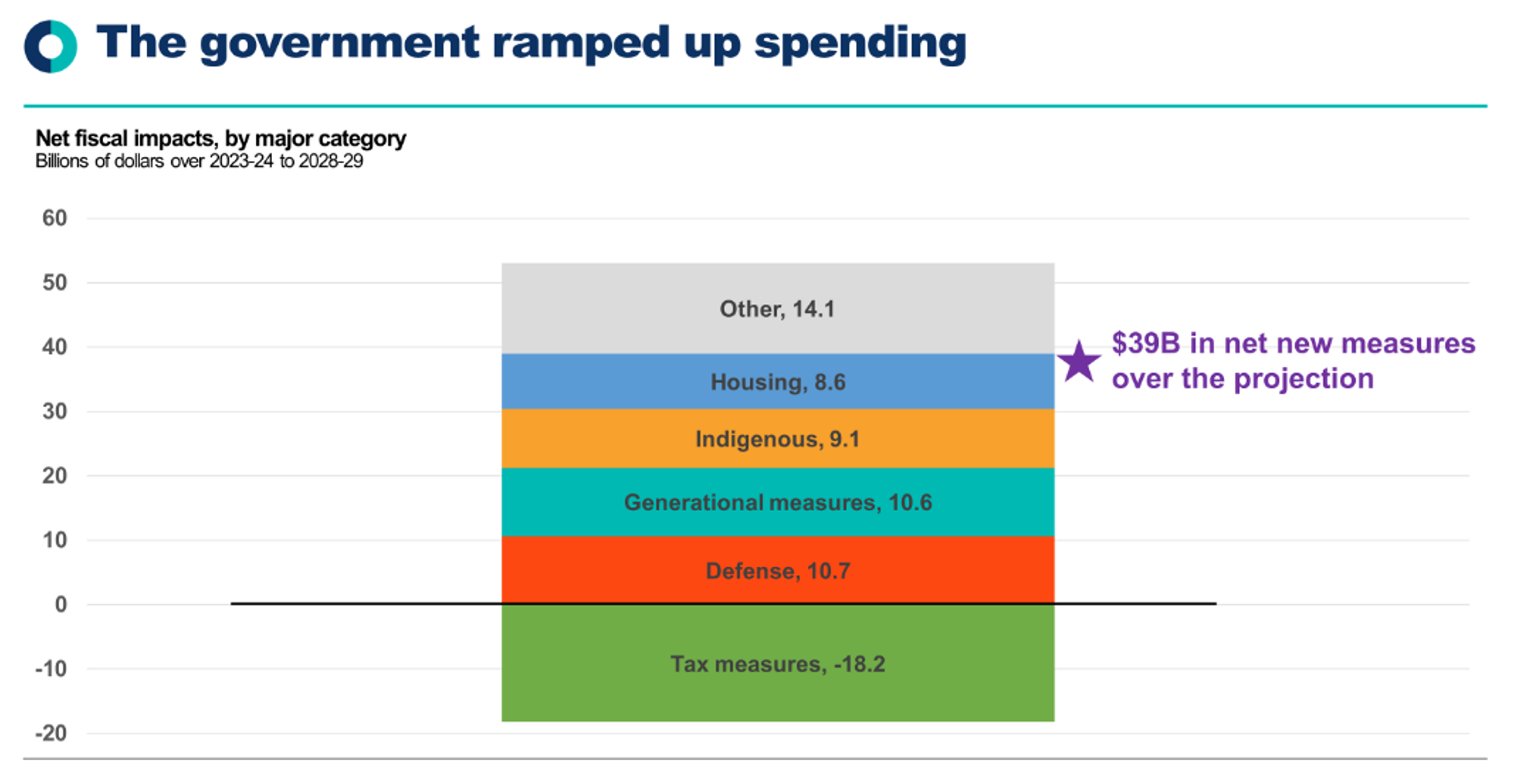

Budget 2024 puts the price tag at roughly $57 billion in new measures over the projection period. This nets out to nearly $40 billion, after taking account of new tax measures (which are expected to bring in $18 billion).

There are numerous ways to break down these moves. I put them into the following categories:- Defense: $10.7B for military and equipment

- Generational measures: $10.6B for various measures including launching the Canada Disability benefit; pharmacare; school food program and more.

- Indigenous Peoples: $9.1B including education, infrastructure, health care and policing.

- Housing: $8.5B for a wide variety of measures to address the housing crisis.

- Other: $14.1B which includes support for artificial intelligence, research,

various investment tax credits (EV supply chain; clean electricity; clean tech manufacturing), as well as renewed funding for the Chamber’s Business Data Lab. - Tax measures: $18.2B largely focused on “taxing the rich” by raising the inclusion rate on capital gains above $250k annually (from 50% to 66.6%), among other measures.

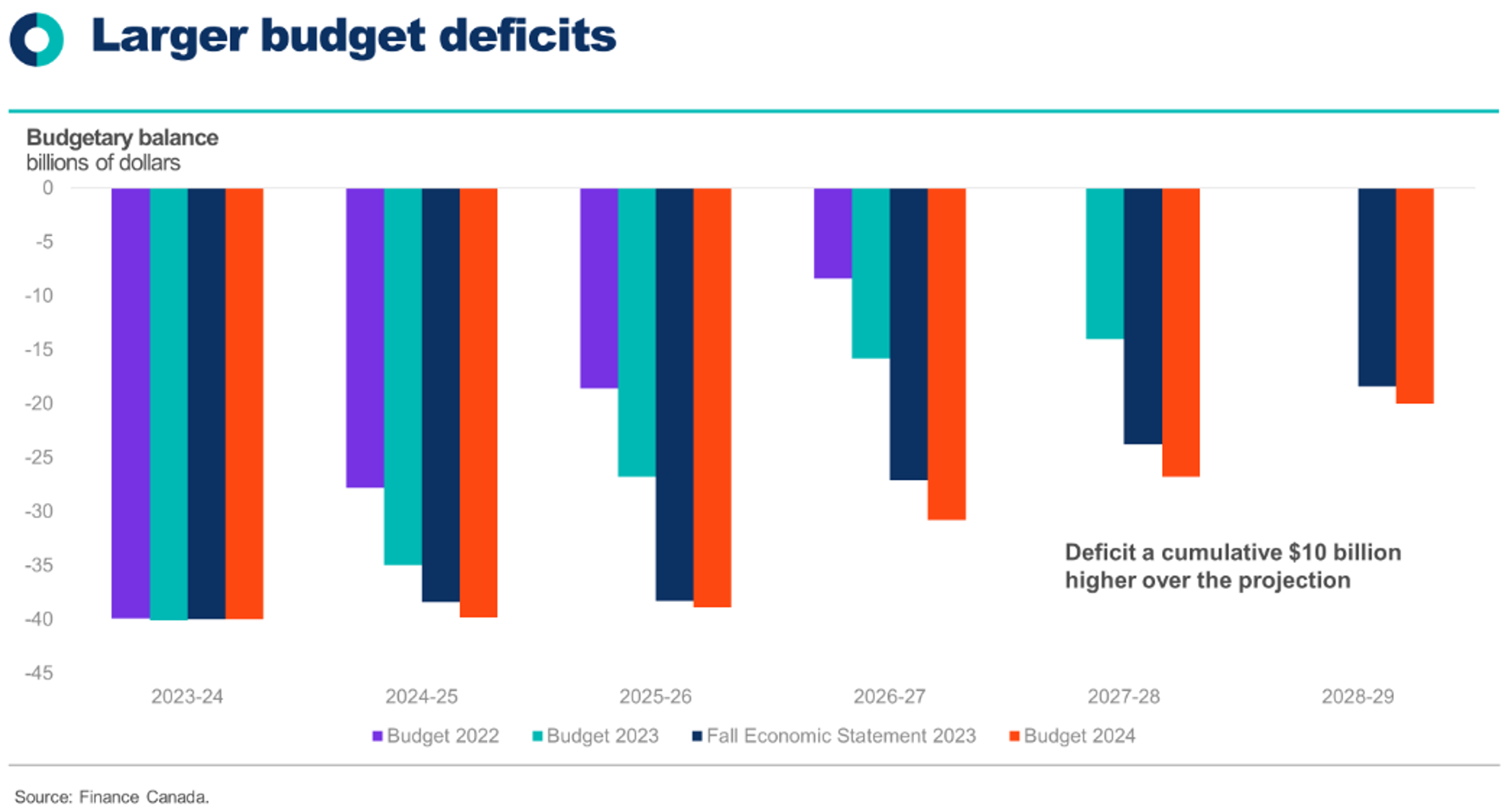

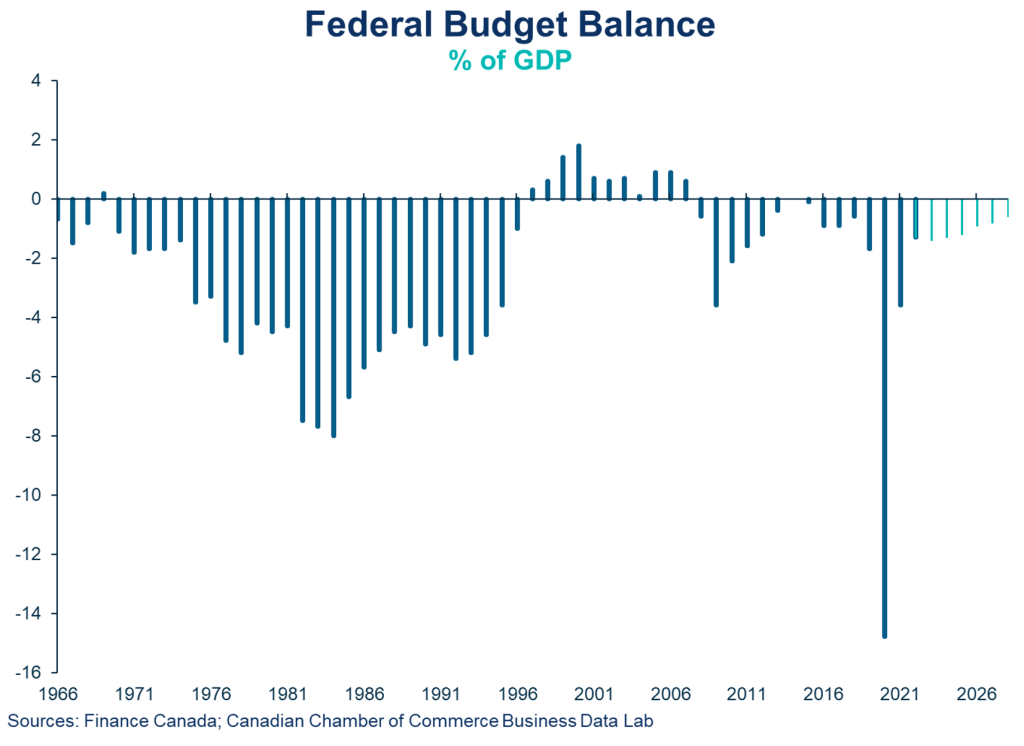

- Fiscal Outlook: New spending measures more than take up the room coming from the somewhat better economic outlook. As a result, the deficit is now expected to be a cumulative $10B higher over the projection.

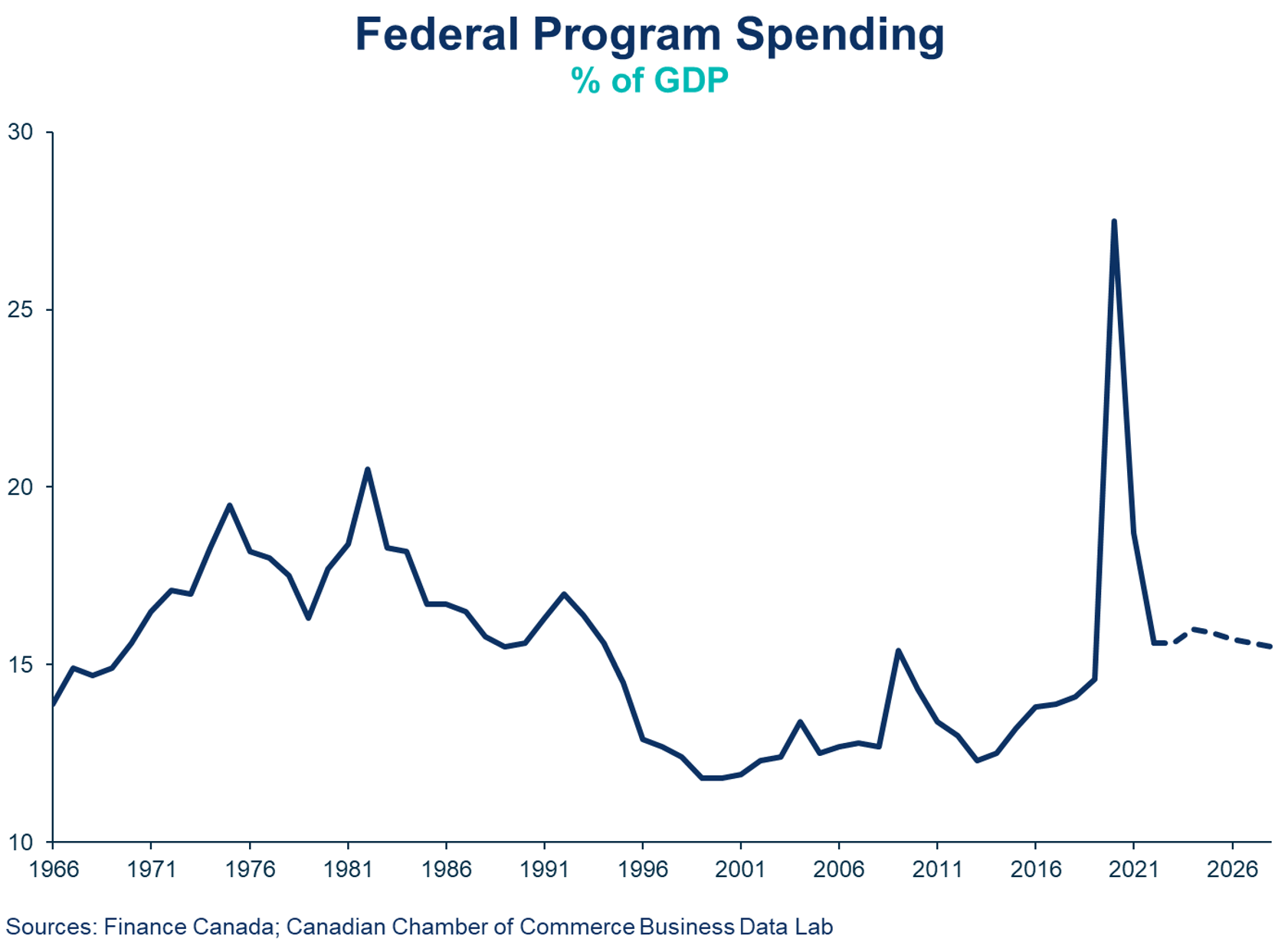

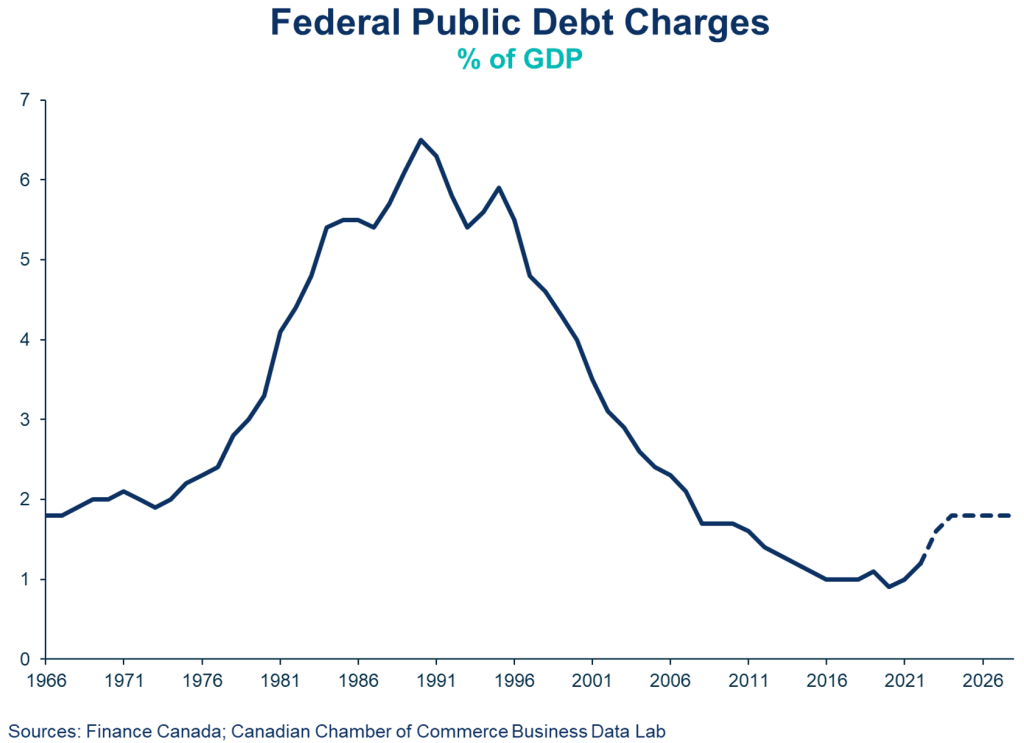

- For context, the federal deficit is expected to come in around $40 billion for the fiscal year that just ended. This amount is expected to remain relatively stable for the next two years before showing a more noticeable decline starting in 2026 and continuing thereafter. These deficits remain manageable as a share of GDP (even in the downside scenario), but the lack of a return to balanced budgets will still cause concern for fiscal hawks. Deficits are expected to shrink modestly each year as a share of GDP, from 1.3% this year, trending in the 1% range, and ending the forecast at 0.6%.

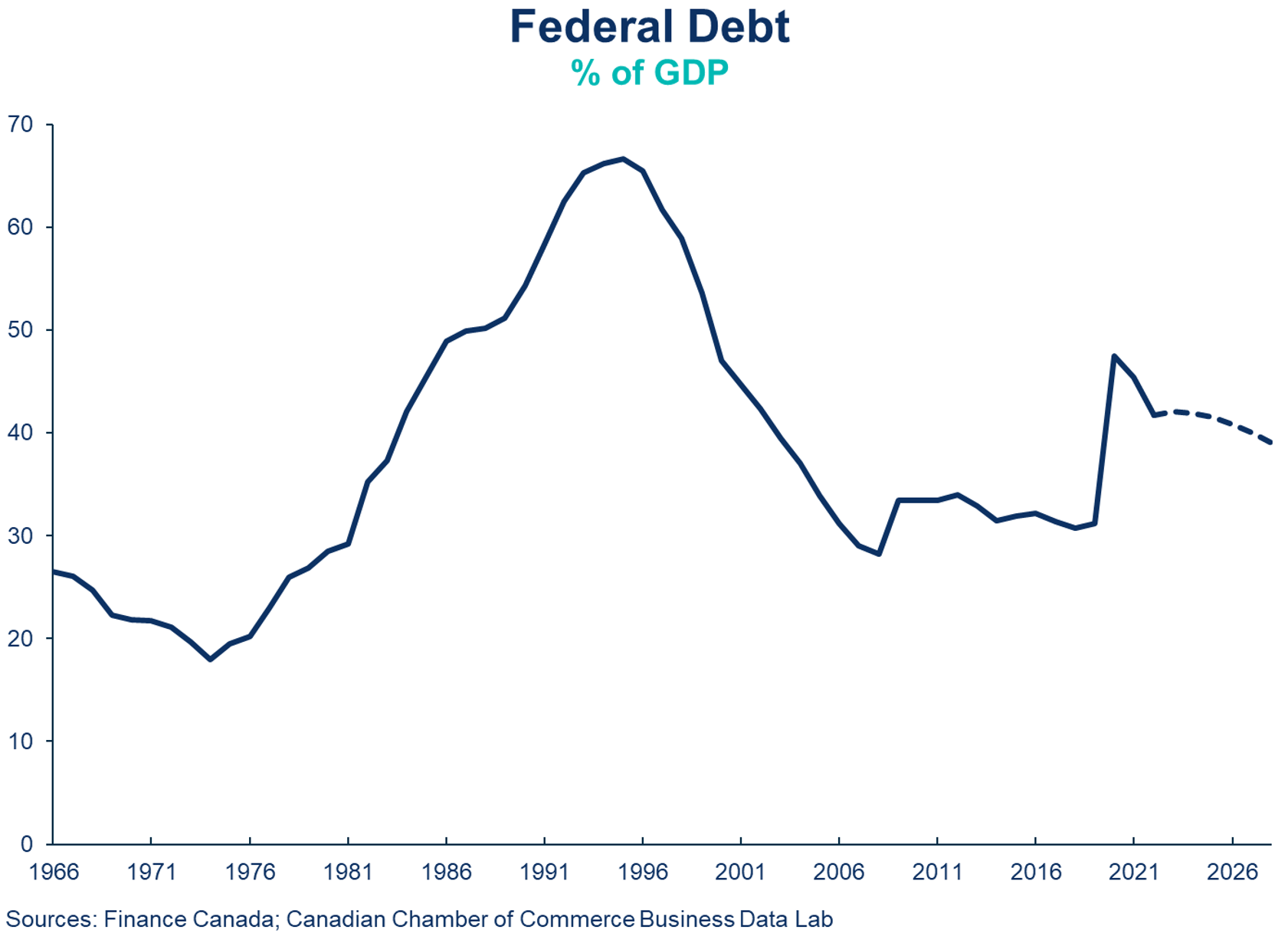

- Debt: The federal debt is expected to rise by more than $150 billion over the projection, reaching $1.4 trillion five years out. As a share of GDP, federal debt starts at 42%, declining slowly to 39% in 2028.

- “Fiscal anchors” and long-run sustainability: The 2023 Fall Economic Statement introduced several fiscal objectives, all of which Budget 2024 is able to check off, namely:

- In absolute terms, to keep the 2023-24 deficit at, or below, the $40.1 billion projected in Budget 2023.

- Lower the debt-to-GDP ratio in 2024-25, relative to the Fall Economic Statement, and keep it on a downward track thereafter; and finally

- Maintain a declining deficit-to-GDP ratio in 2024-25, and keep deficits below 1% of GDP in 2026-27 and future years.

Looking further out, Finance Canada’s long-term projections show the status quo federal debt ratio on a steady decline over the next 30 years, even in the downside scenario. This should be taken with a few grains of salt, however, since it assumes no additional spending beyond status quo measures, which has not been the historical experience.

More Fiscal Charts

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.