Commentaries /

April 2024 GDP: The Canadian economy is slowing, but there’s a bit more gas left

April 2024 GDP: The Canadian economy is slowing, but there’s a bit more gas left

The Canadian economy grew as expected in April, driven by key sectors like services for oil and gas extraction.

Andrew DiCapua

The Canadian economy grew as expected in April, driven by key sectors like services for oil and gas extraction. Anticipated growth in the coming months could be bolstered by the opening of the Trans Mountain pipeline. Despite resilience in the first half of the year, the economy is on track for 1.7% annualized growth in the second quarter, slightly above the Bank of Canada’s forecast. We’ll have to monitor incoming inflation data closely, but this suggests that the economy may need more time to decelerate for the Bank’s comfort.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

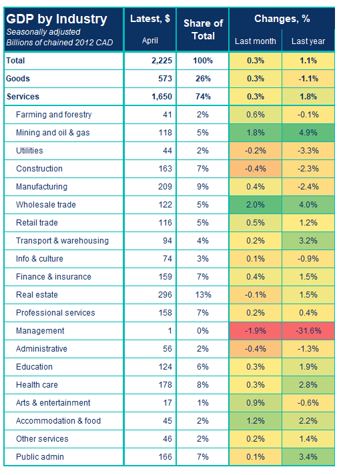

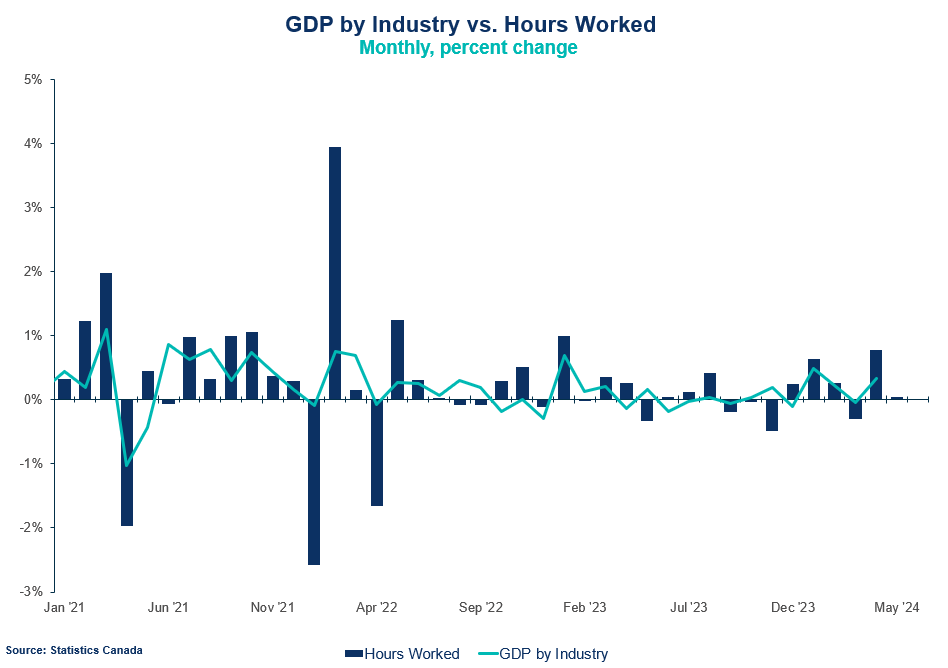

Real gross domestic product rose 0.3% in April, on pace with consensus forecasts. Growth was broad-based across sectors and both goods and services grew at 0.3% m/m. This sets up the second quarter for a good start, but the Canadian economy is slowing from the strong first quarter.

Movers and shakers

- 15 out of 20 sectors experienced growth, notably wholesale trade, manufacturing, and mining, oil and gas.

- The manufacturing sector expanded by 0.4%, driven by durable goods, particularly transportation equipment manufacturing.

- Wholesale trade expanded by 2%, led by motor vehicle parts and personal goods.

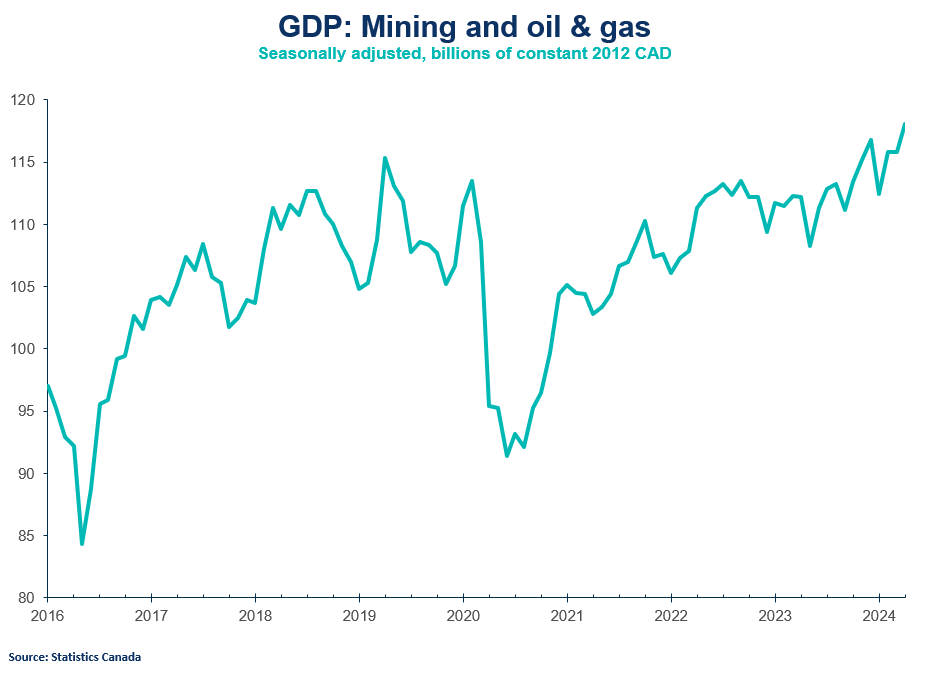

- Mining and oil & gas increased by 1.8%, with strong performance in support activities and oil sands extraction. This is expected to be work in the lead up to the opening of the Trans Mountain pipeline that opened in May.

- The services-producing industries rose by 0.3%, with notable contributions from transportation and warehousing, and professional, scientific, and technical services.

- Notably construction declined by 0.4%, with residential building construction contracting by 2.3%. Utilities also experienced negative growth, declining 2.7%, influenced by warmer than usual weather reducing heating demand.

OUTLOOK AND IMPLICATIONS

The advanced estimate for real GDP in May is 0.1%. This puts the second quarter on track to grow by roughly 1.7% annualized, which is slightly higher than the Bank of Canada’s April forecast of 1.5%. We’ll need to pay attention to inflation data next month to assess implications for monetary policy. Nonetheless, the second quarter is poised to be decent growth, following a stronger first quarter.

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022