Commentaries /

2023 Q1 CSBC: Cost Problems Persist

2023 Q1 CSBC: Cost Problems Persist

The latest Canadian Survey on Business Conditions shows that companies continue to struggle with rising costs. Even as headline inflation slows, the share of businesses expecting to raise prices next quarter held steady at one third — a stat that may worry the Bank of Canada.

Stephen Tapp

The latest Canadian Survey on Business Conditions shows that companies continue to struggle with rising costs. Even as headline inflation slows, the share of businesses expecting to raise prices next quarter held steady at one third — a stat that may worry the Bank of Canada.

The impact of higher interest rates is not only adding to firms’ price pressures, but also appears to be restraining investment and hiring intentions.

On the plus side, long-standing supply-side challenges related to the workforce and supply chains are improving. And while the near-term outlook for sales is clearly subdued, all things considered, most companies remain optimistic about the year ahead.

– Stephen Tapp, Chief Economist, Business Data Lab

KEY TAKEAWAYS

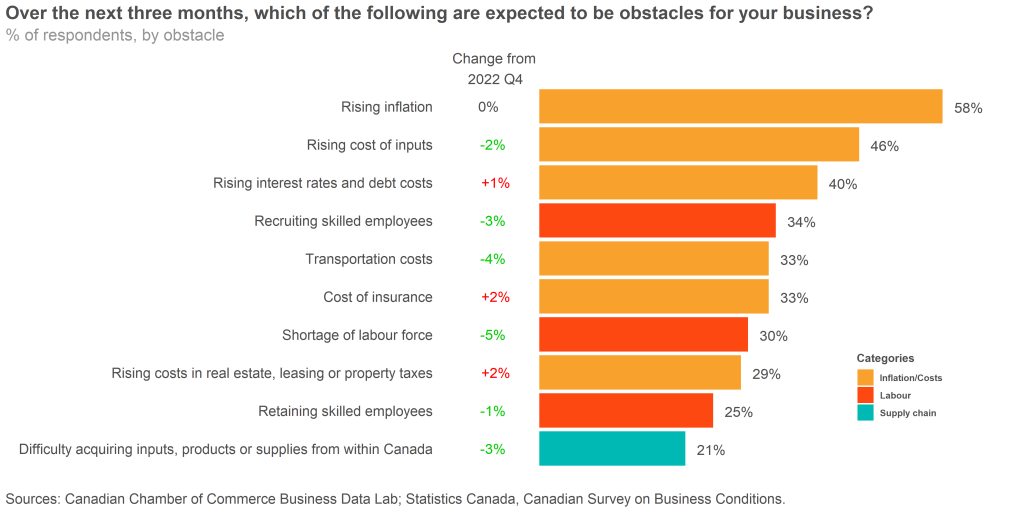

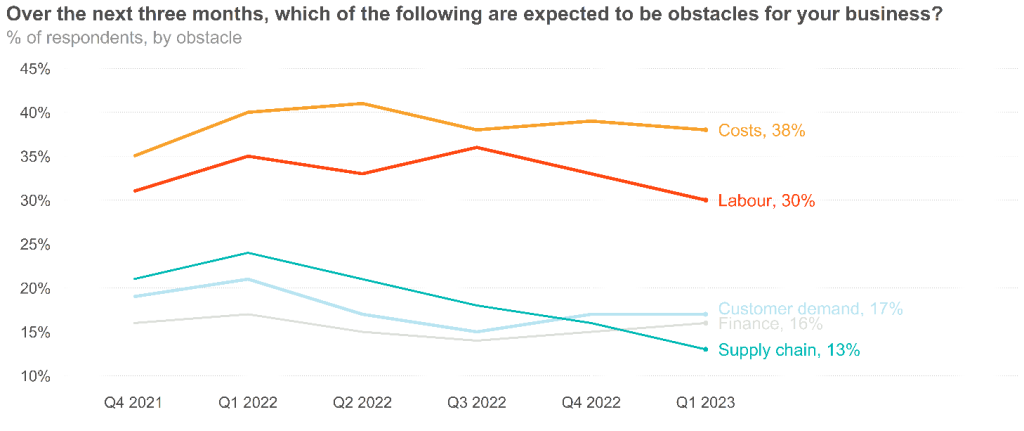

COST AND PRICE PRESSURES

- The rising costs of doing business remains the biggest challenge for Canadian companies. Even though inflation is slowing, it’s still the top individual pain point, cited by 58% of businesses, followed by rising input costs (46%) and interest rate and debt costs (40%).

- By sector, cost pressures are most acute in mining, oil and gas; accommodation and food services; and agriculture.

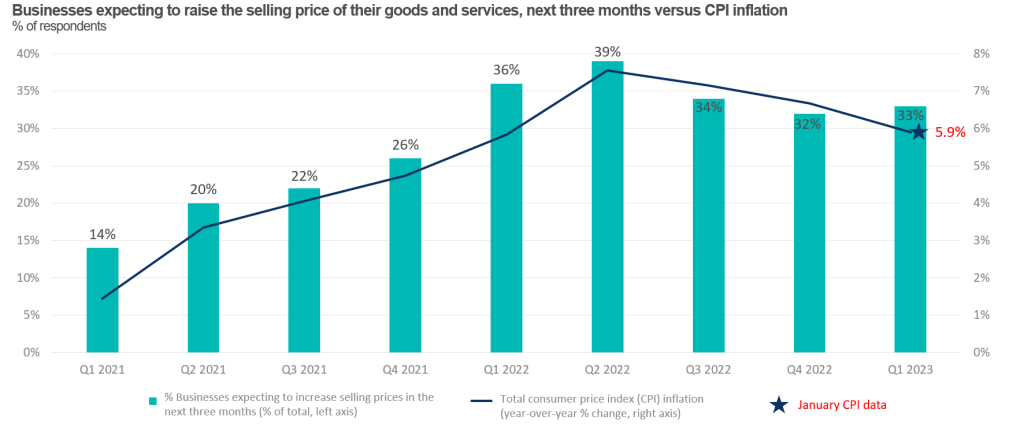

- One-in-three businesses expect to raise their prices in the coming quarter. After peaking at 39% in 2022 Q2, this share has held steady since.

- Output price pressures appear strongest in accommodation and food services and retail trade; and weakest in finance and real estate.

- Central banks across the world have quickly raised interest rates to reduce inflation from generational highs. Canadian businesses struggling to cope with higher interest rates are responding in various ways. Among the 40% of businesses facing such issues, 46% expect to raise prices; 31% to reduce investment; 22% to delay hiring; and 11% to reduce employment.

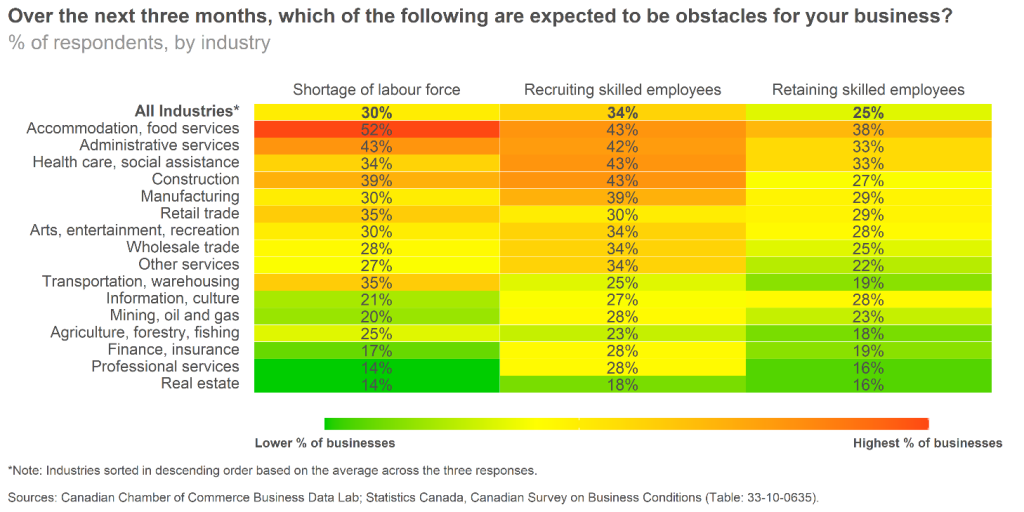

WORKFORCE CHALLENGES

- Recruitment and retention challenges are cited as near-term obstacles for 40% of businesses — moreover, almost 30% of all businesses say labour challenges will have a “medium” or “high” impact on their ability to deliver goods and services.

SUPPLY CHAINS

- After experiencing widespread problems throughout the pandemic, supply chain challenges continue to improve, however, they are still impacting over one quarter (26%) of all businesses.

FUTURE OUTLOOK

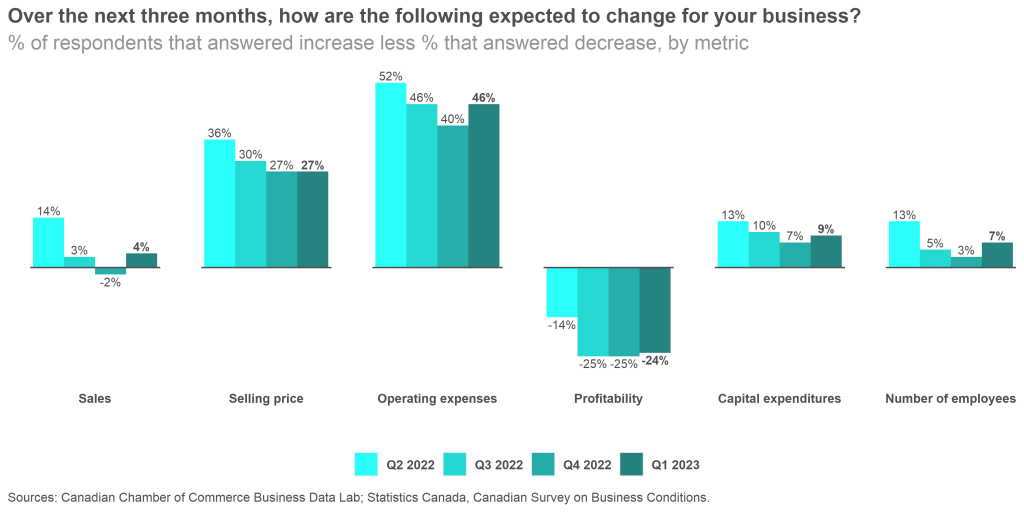

- Slow growth expected: Over the next quarter, Canadian businesses generally have subdued expectations for sales, hiring and investment.

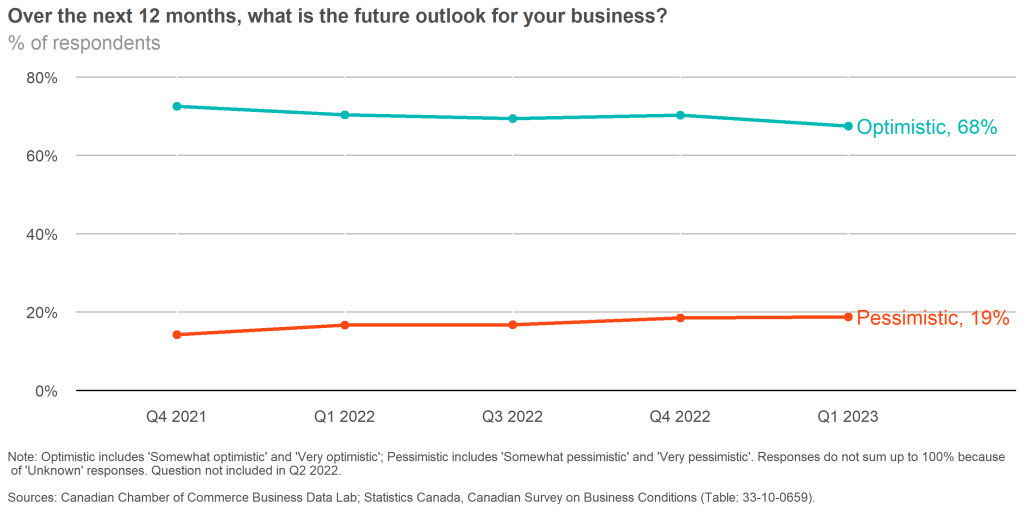

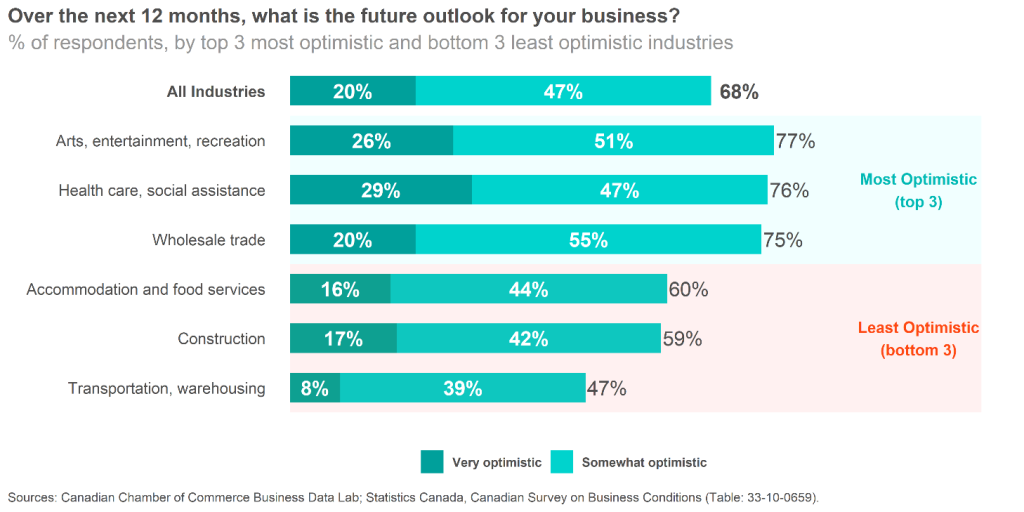

- Despite an expected rough patch for the economy in the near term, over two-thirds (68%) of companies are optimistic about their future outlooks over the next year. Optimism is highest for those in arts, entertainment and recreation, health care and wholesale trade; and lowest for transportation; construction and accommodation and food services.

Costs and labour challenges remain the biggest areas of concern for businesses.

Even as headline inflation slows, the share of companies expecting to raise prices is holding steady.

Labour challenges are most acutely felt in services such as accommodation and food, admin and health care, as well as goods-producing sectors of construction and manufacturing.

Over the near term, businesses have subdued expectations for sales, hiring and investment, while expenses continue to rise, and profits are expected to be squeezed.

The business outlook for the next 12 months is slightly weaker than last quarter, but is holding up well all things considered.

For the year ahead, firms in arts, entertainment and recreation, health care and wholesale trade are in the highest spirits.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022