Commentaries /

2022 Q4 Canadian Survey on Business Conditions: Businesses temper their outlook, as cost and labour challenges overstay their welcome into the year ahead.

2022 Q4 Canadian Survey on Business Conditions: Businesses temper their outlook, as cost and labour challenges overstay their welcome into the year ahead.

A look into the 2022 Q4 Canadian Survey on Business Conditions results.

Business Data Lab

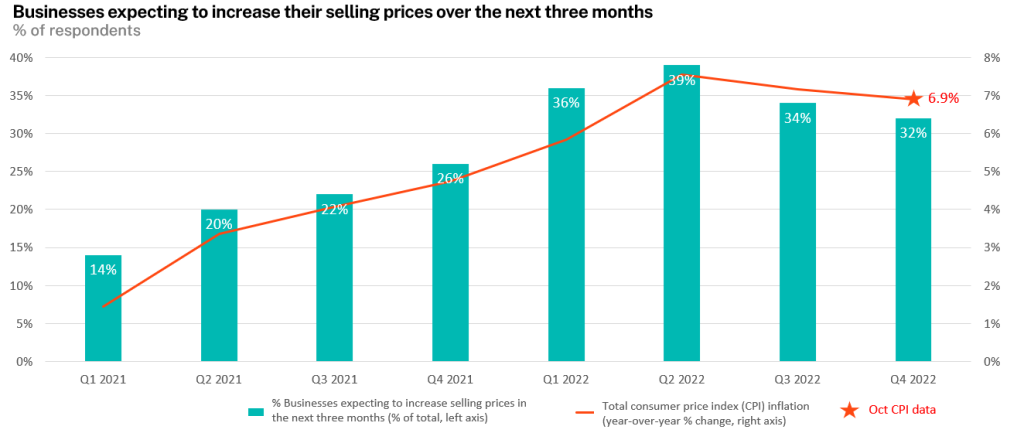

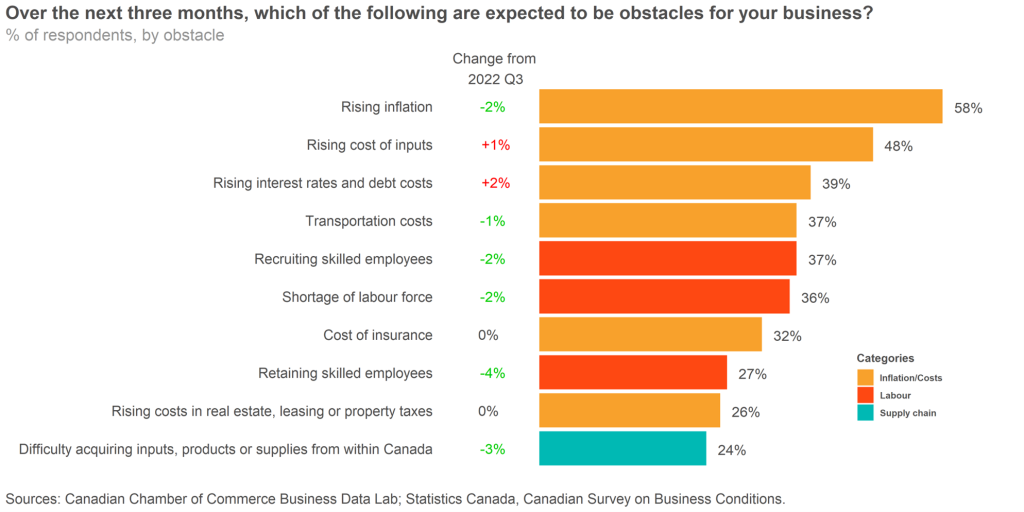

With the costs of doing business remaining high, Canadian firms continue to temper their expectations as per the fourth quarter results of the Canadian Survey on Business Conditions. Inflation remains the top pain point — with nearly 60% of businesses reporting that inflation will be an obstacle in the next quarter — followed by rising costs of input and debt costs.

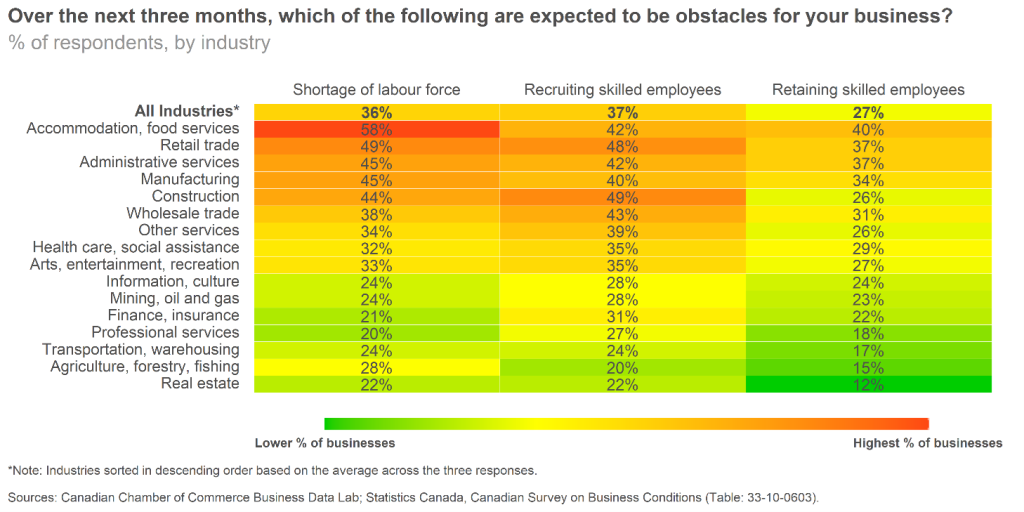

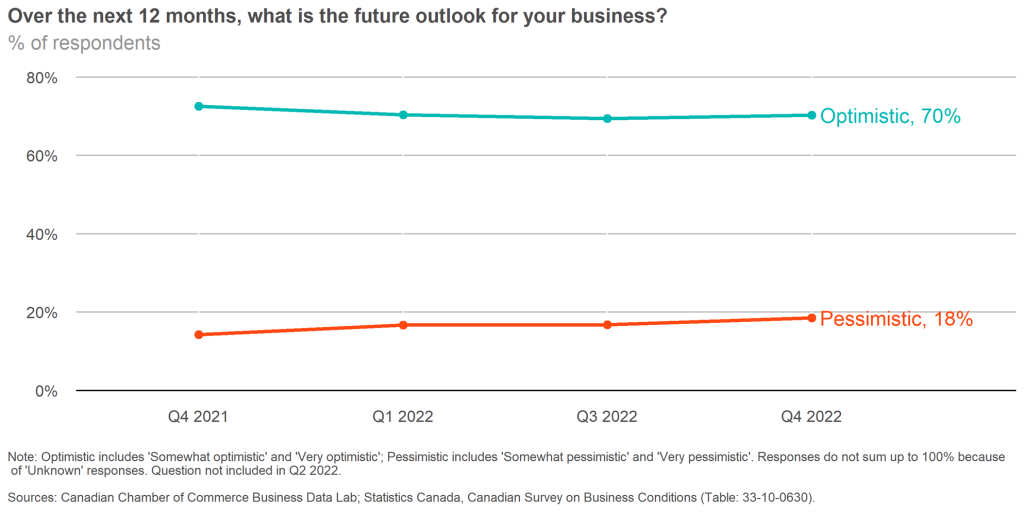

Labour challenges are also forecast to persist into 2023 with 40% of businesses expecting recruitment and retention obstacles over the next quarter, particularly in service sectors. However, despite these ongoing challenges, longer-term business sentiment remains confident with 70% of businesses being optimistic about their outlook over the next 12 months.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

Key Takeaways

- The rising costs of doing business are the top obstacles for Canadian companies as they look to a new year ahead. Persistent inflation is the biggest pain point, cited by well over half of all businesses (58%), followed by rising input costs (48%) and debt costs (39%).

- More than half of businesses in wholesale trade (63%), retail trade (59%), and the construction sector (55%) cite rising input costs as an obstacle for the next quarter. Thankfully, these sectors have also moderated their expectations in this regard over the past year.

- Workforce woes keep businesses on their toes. With talk building related to ambitious immigration targets, recruitment and retention challenges are cited as near-term obstacles for 42% of business.

- Businesses in accommodation and food services, retail, administrative services, and construction are dealing with these labour issues the most. Of businesses that expect near-term labour obstacles, 61% reported that recruitment and retention challenges have worsened over the past 12 months.

- Supply chain issues are becoming less troublesome: more than six out of 10 businesses either expected supply chain challenges to remain the same or improved in the near term. The share of businesses expecting difficulty acquiring domestic inputs also improved (24% vs 27% last quarter).

- While firms are responding to recent improvements in global supply chains, for the ones expecting continued bottlenecks, over half (56.0%) expect them to continue for six months or more. This is up slightly from last quarter (54%).

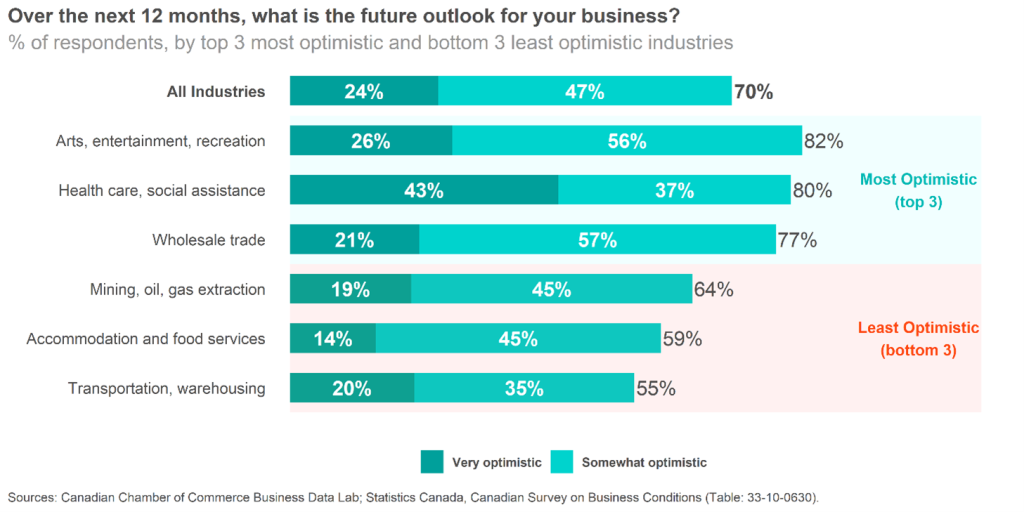

- Slowing growth expected: Business optimism across industries has tempered over the course of this year. Still there are silver linings. Despite downward expectations related to costs and labour challenges ahead, firms in arts, entertainment and recreation, healthcare and wholesale trade are the most optimistic. Transportation, accommodation and food services and the oil and gas sector have fewer hopeful outlooks.

Inflation still the top business obstacle, followed by rising input and debt costs.

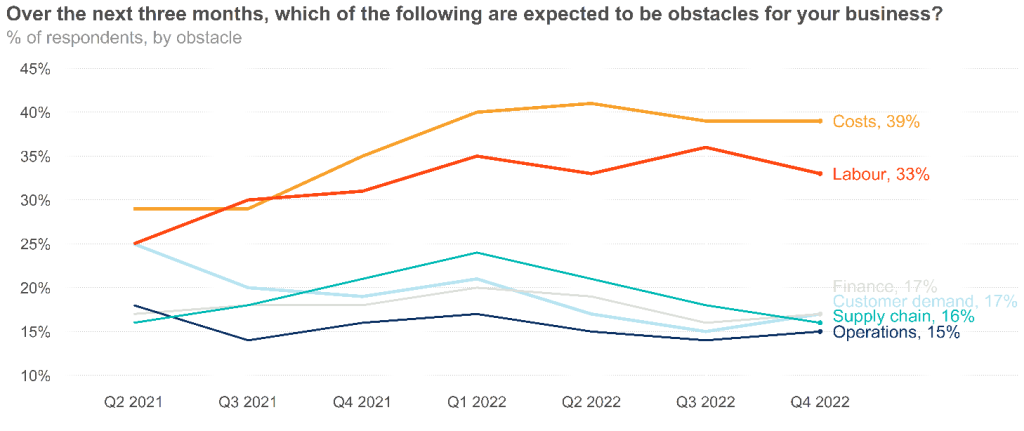

Costs and labour challenges remain as chronic pain points.

While on a downward trend from last quarter, labour-related obstacles are most acutely felt by businesses in service sectors especially, accommodation and food services, and retail.

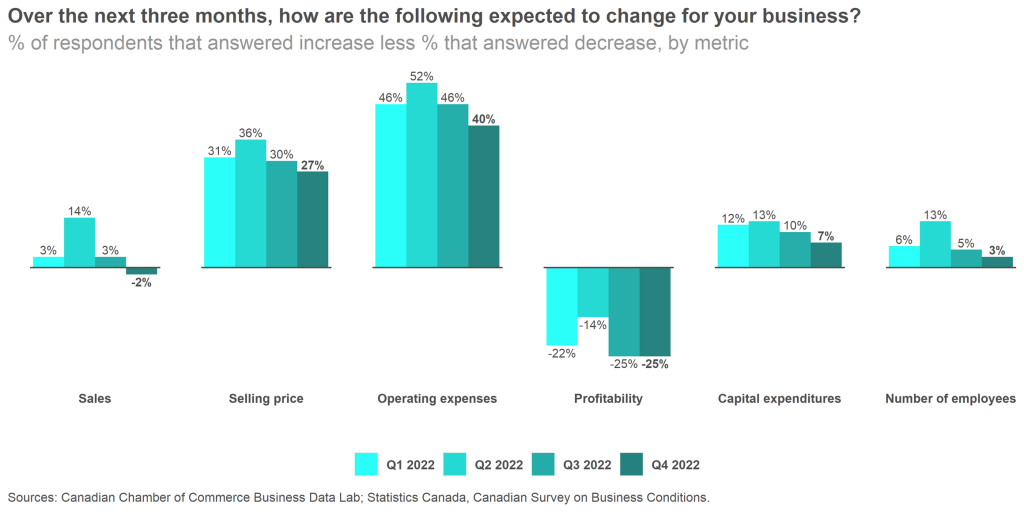

Canadian businesses continued to lower their growth expectations – the outlook for sales now has more firms expecting them to fall than to rise in the next three months.

The Canadian business outlook has tempered slightly going into 2023.

When it comes to outlook for the year ahead, firms in arts, entertainment and recreation, healthcare and wholesale trade continue are in higher spirits.

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022