Publications /

Summer 2024 Business Conditions Terminal Update

Summer 2024 Business Conditions Terminal Update

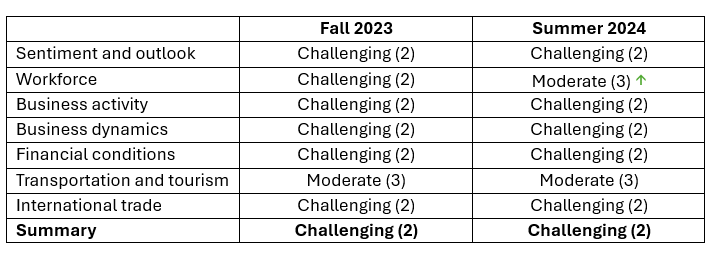

After reviewing the recent shifts in a wide variety of dashboards available in our Business Conditions Terminal, the BDL continues to assess business conditions in Canada as "challenging".

Andrew DiCapua

After reviewing the recent shifts in a wide variety of dashboards available in our Business Conditions Terminal, in this summer update, the BDL continues to assess business conditions in Canada as “challenging” (a rating of 2 on a 5-point scale).

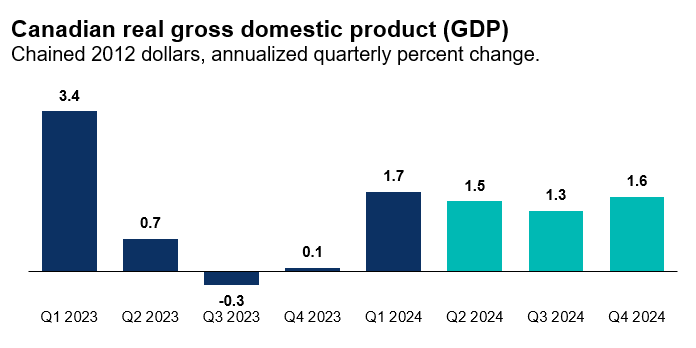

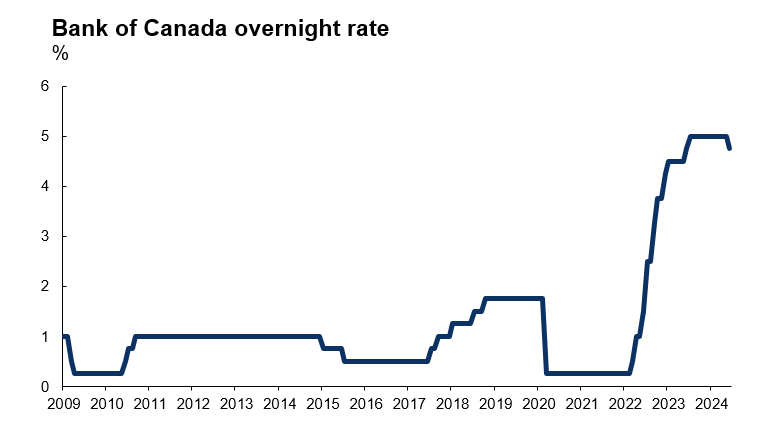

As we navigate through 2024, the Canadian economy faces a complex landscape characterized by mixed signals and evolving challenges. Following a few quarters of weak growth, Canadian GDP rebounded in the first quarter of 2024, inflation is slowly moving closer to the two percent target, and businesses are signaling that their near-term prospects are improving. With the Bank of Canada beginning to ease monetary policy in June, a “soft landing” for Canada’s economy remains in sight. The latest signals from our Local Spending Tracker suggest that real consumer spending growth per capita remains quite weak.

Sentiment and Outlook: Anticipation of Improved Growth

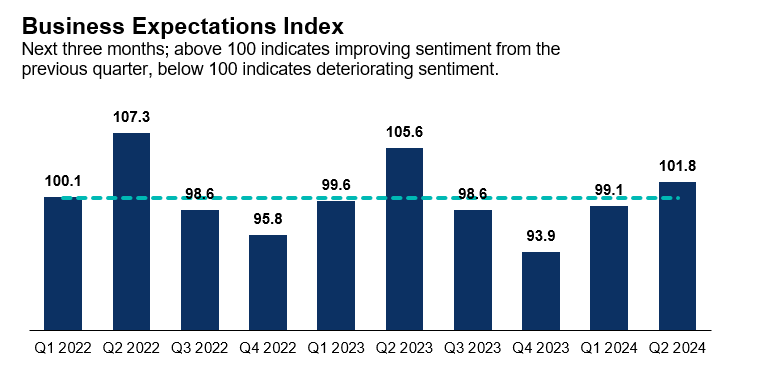

Despite Canada’s GDP growth rebounding to 1.7% annualized in Q1 2024, marking the strongest performance in four quarters, growth is forecasted at roughly 1% for the year overall. Business and consumer sentiment are improving amid a challenging affordability landscape but remain below historical averages. Economic growth is expected to tick up in the second half of the year as financial conditions ease, but the economy is still expected to grow below its long-run potential.

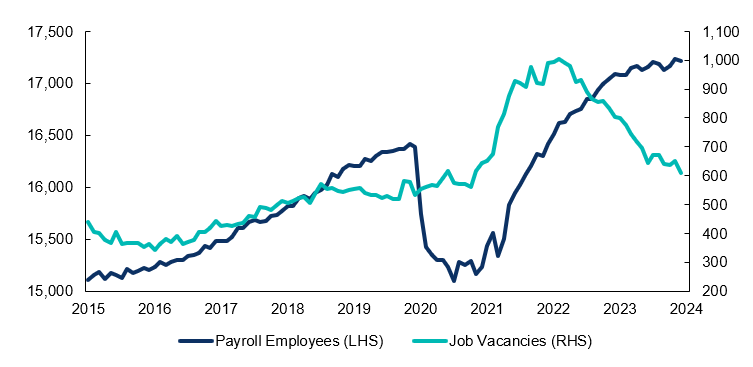

Workforce dynamics: Closer to Balance Market

The labour market presents a mixed picture. Employment growth has slowed. The unemployment rate has risen by over a full percentage point from its low to 6.2% and is being pushed up by strong labour force growth driven by rapid immigration flows. Despite higher unemployment and a rebalancing of the labour market, wage growth remains resilient at 4% to 5% on an annual basis, although it is expected to decelerate as job vacancies return to pre-pandemic levels.

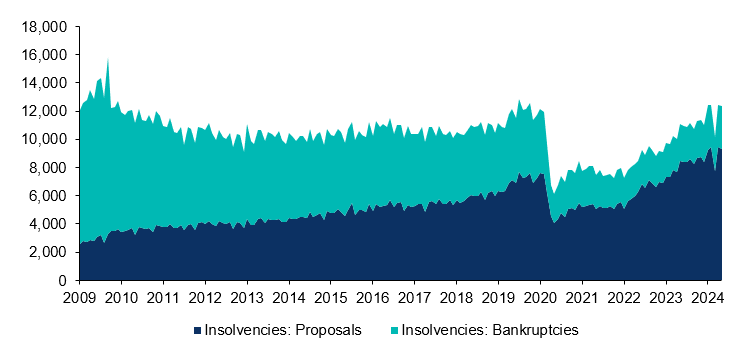

Business Activity and Dynamics: Insolvencies Still Too High But Signs of Improving

Business activity in Canada remains challenging with insolvencies near 10-year highs. Businesses insolvencies are being driven by an increase in proposals rather than bankruptcies as lenders work with troubled borrowers. The number of active businesses has increased since the last quarter despite business closures rising on an annual basis.

Financial Conditions: Interest Rates Are On the Way Down

With the Bank of Canada leading the G7 with the first interest rate cut, financial conditions are beginning to ease. With the overnight rate at 4.75% more easing will be required to improve financing conditions for households and businesses alike, but the future direction of monetary policy is clear. Inflation is making progress, moving closer to the two percent target and markets are expecting more rate cuts this year in Canada and internationally.

Tourism and Transportation: Resilient Amid Challenges

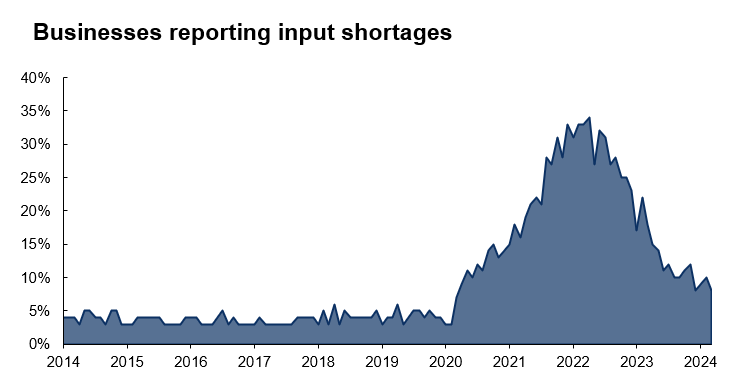

Global supply chains continue to improve despite lingering geopolitical tensions and labour disputes. Fewer businesses are reporting input shortages and delivery times have remained stable with Canadian suppliers indicating progress. Global shipping rates have recently risen with attacks in the Red Sea disrupting shipping routes in the region. Tourism enjoyed solid growth last summer and demand is expected to stay seasonally robust.

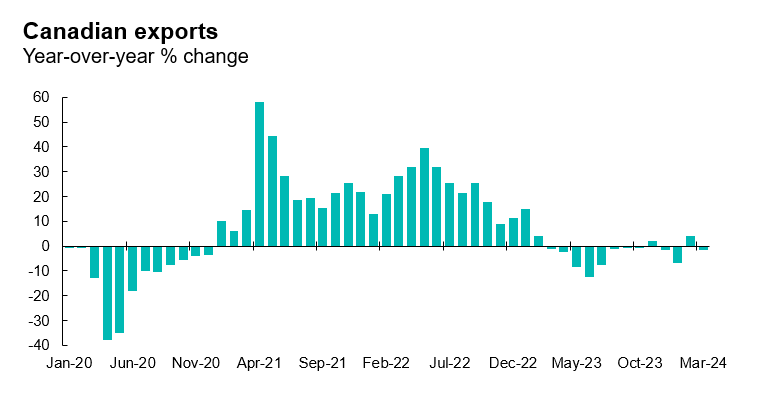

International Trade: Muted Growth

Global trade is moderating with volumes flat and prices declining. Global manufacturing orders are stabilizing as most countries remain on the cusp of expansion territory. Canada’s services trade continues to rebound, primarily driven by the recovery in travel and tourism. Despite the challenging operating environment, confidence levels among Canadian exporters are rebounding, posting the highest level since the mid-2022, but are still below the historical average.

Conclusion: Optimism Amidst Caution

Canada’s economic outlook is characterized by cautious optimism. The current period of slower growth and higher unemployment is expected to eventually give way to faster growth, underpinned by supportive monetary policy and improving financial conditions. Businesses should remain vigilant and be prepared for evolving economic realities as the outlook remains uncertain. While some aspects of the Canadian economy are improving (notably in the labour market for businesses still looking to hire), our overall assessment continues to be that business conditions in Canada remain “challenging”, all things considered.

Business Conditions Assessment

Other publications

May 02, 2022

10 Takeaways from BDL Consultations

May 18, 2022

The Last Mile of Democratizing Economic Data

Dec 20, 2022