Publications /

Navigating Challenging Business Conditions: Business Conditions Terminal Update

Navigating Challenging Business Conditions: Business Conditions Terminal Update

Canada’s economy is at a pivotal point. As we head into the fall season, there’s a chill in the air, and a chill settling over business conditions. At the Business Data Lab (BDL), we recently expanded our Business Conditions Terminal (BCT) — an online, interactive tool that allows users to stay informed on a wide variety of market conditions through thematic data dashboards.

Rewa

By Andrew DiCapua, Senior Economist, Business Data Lab, Canadian Chamber of Commerce

Canada’s economy is at a pivotal point. As we head into the fall season, there’s a chill in the air, and a chill settling over business conditions. At the Business Data Lab (BDL), we recently expanded our Business Conditions Terminal (BCT) — an online, interactive tool that allows users to stay informed on a wide variety of market conditions through thematic data dashboards. With over 2,300 indicators drawn from more than 30 different sources updated daily, our terminal is “always on.”

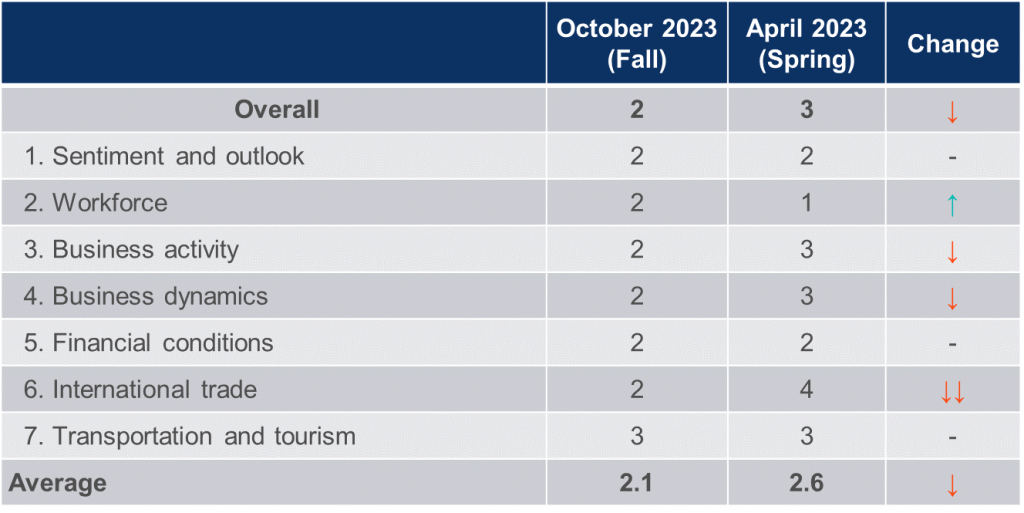

In this blog, we review our latest assessments of Canada’s business landscape, detailing why we’ve downgraded our overall rating of the landscape from “moderate” to “challenging.”

Overall Business Conditions in Canada Are Deteriorating

Canada’s economic activity has experienced a concerning slowdown. This trend is a result of a noticeable pullback in consumer spending, which is most pronounced on a real per capita basis. Although interest rates have been and continue to be at the highest levels in 22 years, real interest rates (i.e., after adjusting for the inflation rate) only became restrictive this spring. This highlights how the long and variable monetary policy lags are only starting to make their way through the system. Consumers, who have driven the economy, have nearly drawn down their pandemic savings. Though resilient, the labour market is undergoing a crucial rebalancing act as job demand slows and supply surges. In addition, the future sales outlook for businesses has become less optimistic, while business insolvencies are on the rise.

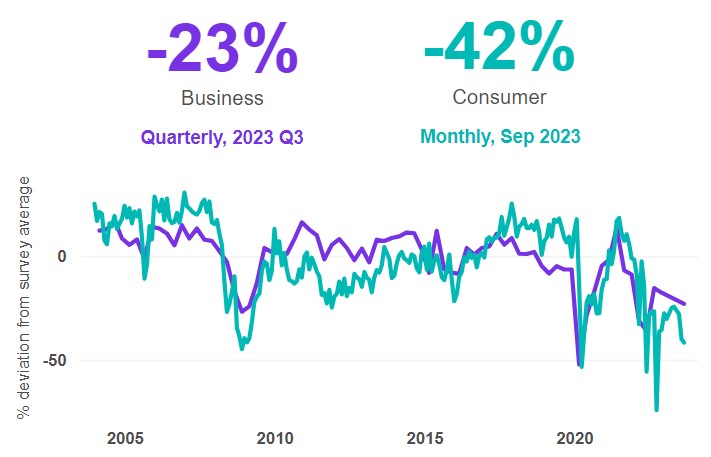

Sentiment and Outlook: A Dip in Confidence

Despite a robust start, Canada’s economy experienced a slowdown in the second quarter and is on pace for essentially zero growth in the second half of the year. Incoming GDP data clearly shows the economy is stagnating. Both business and consumer confidence have plummeted, casting a shadow on the economic outlook. Recession fears have risen, heightening uncertainty in financial markets. Sales and hiring prospects are expected to remain weak over the near term. Although there is an expectation of alleviating inflation and wage pressures, they remain as persistent concerns for most businesses.

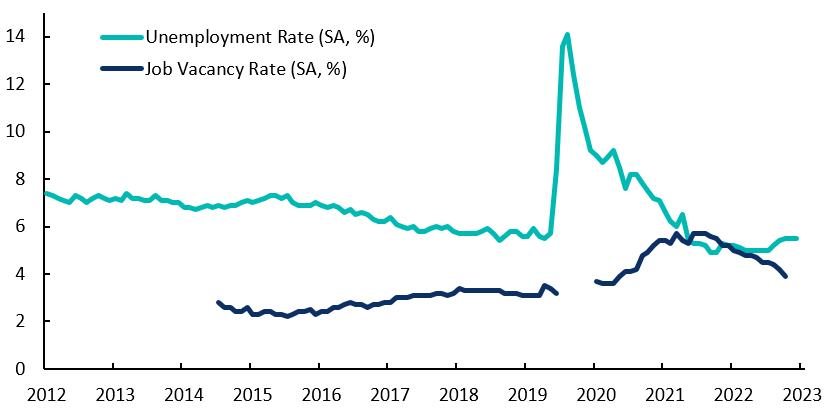

Workforce Dynamics: A Shifting Landscape

Canadian labour market

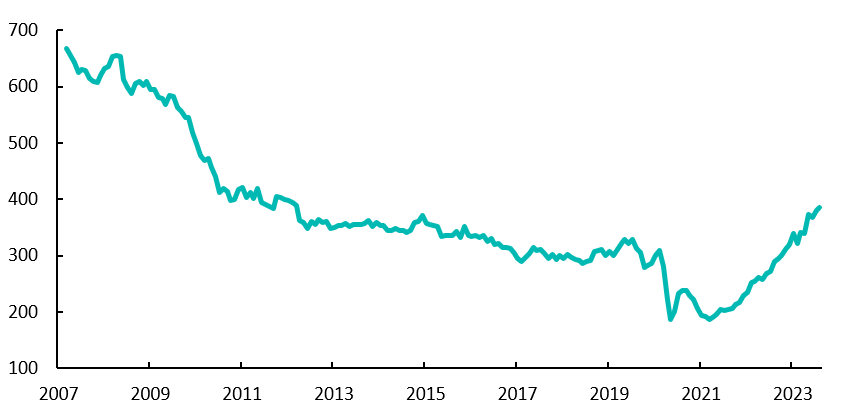

Canada’s labour market, which had exhibited remarkable tightness, has seen a gradual loosening over the past year. Job vacancies are on the decline, while increased immigration is bolstering labour supply. This trend signifies a move towards more balanced market conditions. Despite this, the unemployment rate has inched up from historically low levels, which may eventually lead to slower wage growth. Canada’s population is set to grow 2.7% this year — the fastest pace since the 1950s — thanks primarily to immigration (and non-permanent residents).

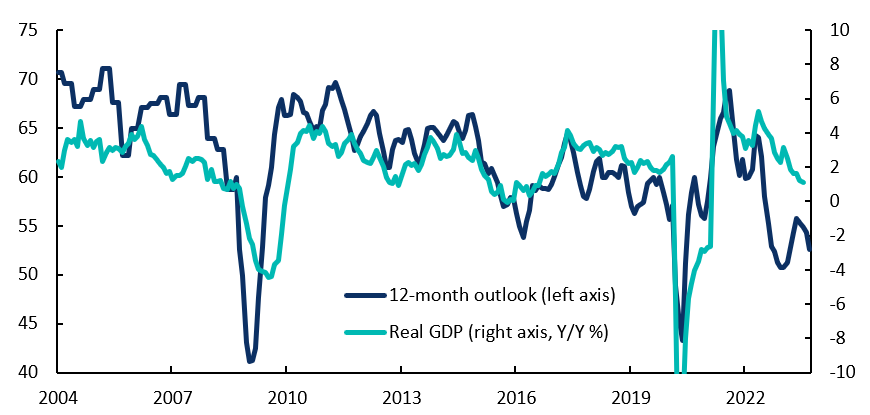

Business Activity: Resilient but Slowing Down

Business outlook and GDP growth

Mirroring the global trend, Canadian GDP growth has slowed. The once tight labour market has now experienced an uptick in unemployment. While business income and profits have taken a hit, there’s been a modest increase in investment — although, business surveys are pointing to a reversal in the short term with slowing investment intentions. This unique adaptability showcases the resilience of Canadian businesses in the face of challenging conditions.

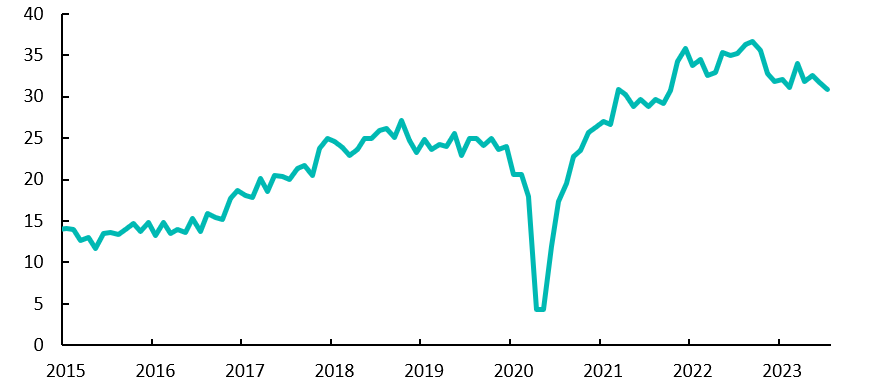

Business Dynamics: Navigating Stormy Waters

Insolvencies, by geography

3-month moving average, seasonally adjusted (SA)

The Canadian business landscape has seen a noticeable reduction in active businesses since the beginning of the year. Closures outpacing new openings, combined with the termination of pandemic support programs and a slowing economy, has resulted in the highest level of business insolvencies in nearly a decade. This trend is expected to continue as borrowing costs are predicted to remain high well into 2024.

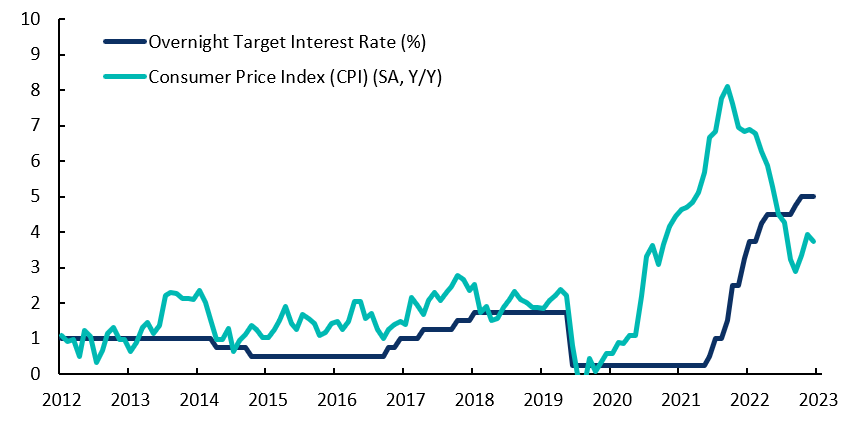

Financial Conditions: Inflation Eases but Markets React to “Higher for Longer”

Canadian interest rates and inflation

Headline inflation has decelerated but remains above central bank targets. The recent surge in oil prices, driven by reduced supply, adds another layer of complexity. Core inflation measures are stuck at stubbornly high levels. Equity markets are anticipating prolonged periods of higher interest rates, leading to declines in most stock indexes relative to the start of this year.

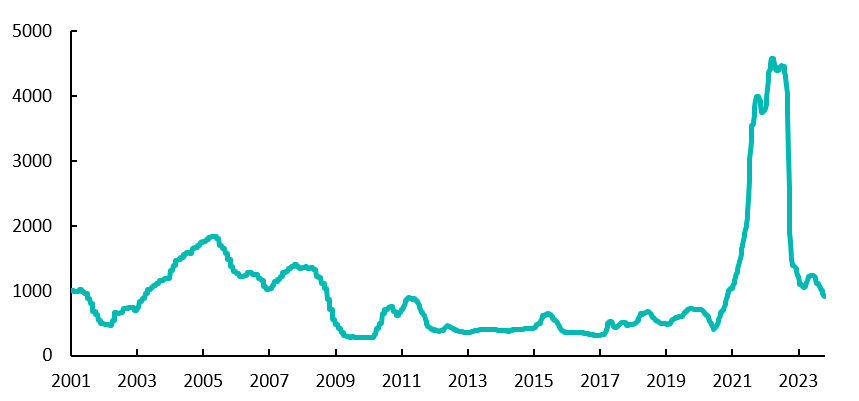

Transportation and Tourism: Overcoming Supply Chain Hurdles

Global shipping rates (HARPEX)

January 2001 = 1000

Global supply chain issues have improved over the past year and a half. Supplier delivery times have shortened, and shipping rates are nearing pre-pandemic levels. While supply chain pressures in Canada persist, there has been a gradual easing. The July port strike in Western Canada caused significant disruptions, but operations have since normalized. Unfortunately, labour strife may be shifting to ports in central Canada. For the tourism sector, the summer saw robust seasonal demand for air travel. However, supply constraints continue to hinder some activities.

International Trade: Adapting to Global Trends

Global trade volumes

Cumulative % change since 2010

Global trade has seen a decline due to weakened prices and volumes. Forward-looking indicators hint at further slowdowns in activity. Canada’s merchandise trade has mirrored this trend, reflecting subdued global demand. On the flip side, services trade continues to rebound, primarily driven by the recovery in travel and tourism. Despite these dynamics, confidence levels among Canadian exporters remain weak.

Conclusion

Our rating downgrade from “moderate” to “challenging” underscores the complex Canadian economic landscape. Successfully navigating the economic landscape requires adaptability, resilience, and a keen understanding of the shifting dynamics. To be competitive in these uncertain times, businesses will need to stay informed and agile.

Other publications

May 02, 2022

10 Takeaways from BDL Consultations

May 18, 2022

The Last Mile of Democratizing Economic Data

Dec 20, 2022