Commentaries /

May 2023 GDP: Better than expected GDP growth increases odds of additional rate hikes

May 2023 GDP: Better than expected GDP growth increases odds of additional rate hikes

After a surprise uptick in April’s inflation, this much anticipated first quarter GDP reading proves the economy still has some steam left in its engine.

Rewa

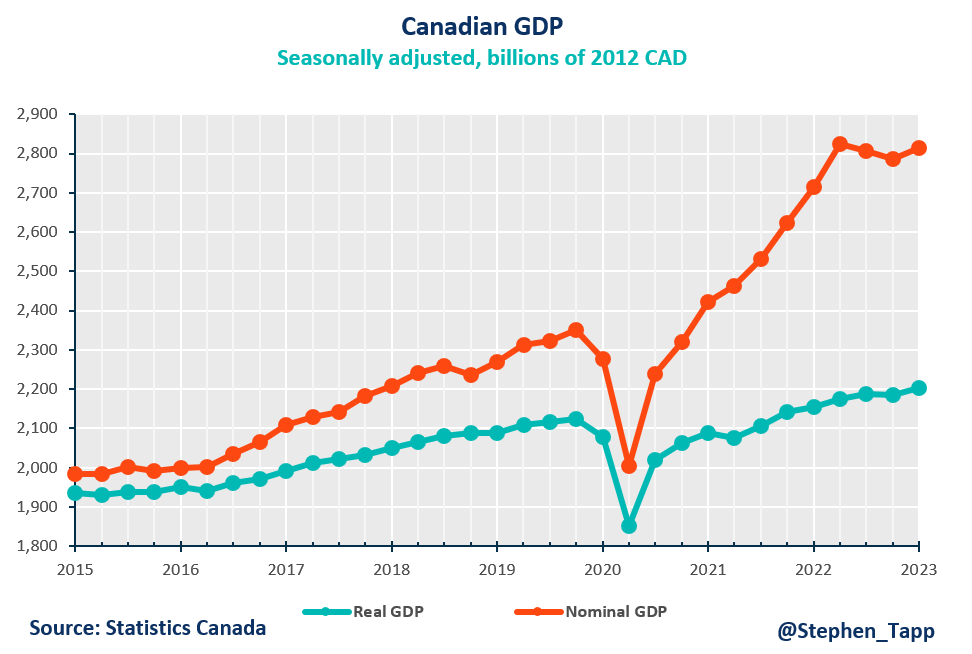

After a surprise uptick in April’s inflation, this much anticipated first quarter GDP reading proves the economy still has some steam left in its engine. As we anxiously await the Bank of Canada’s upcoming policy rate decision next week, the possibility of at least another hike becomes more real. While forecasters project a slight slowdown for the remainder of the year, it may take longer than anticipated for the combined effects of monetary policy tightening and rising interest rates to sufficiently dampen excessive demand and restore balance to the economy, albeit at a slower pace than desired.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

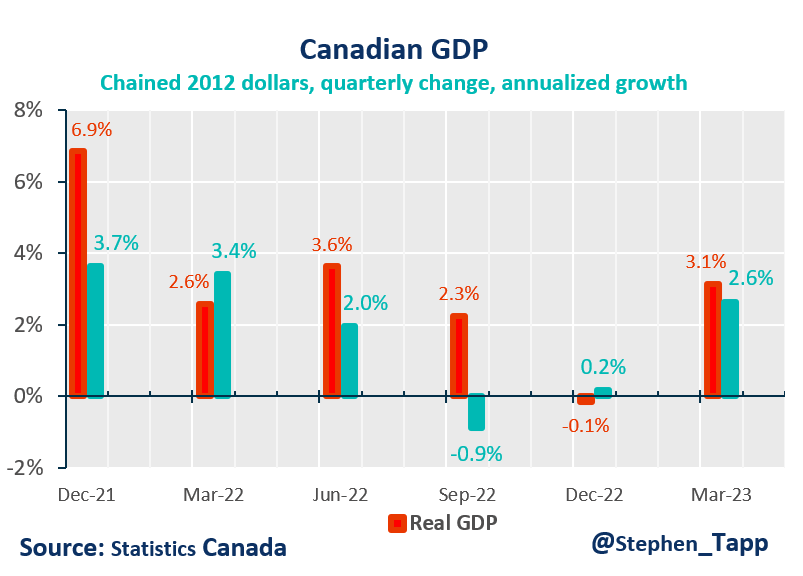

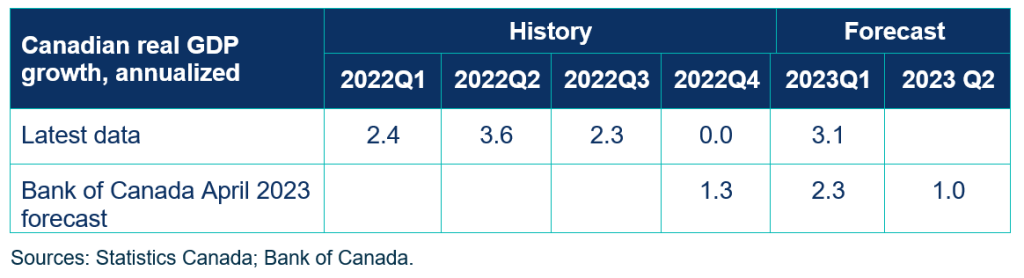

- Canada’s real gross domestic product (GDP) growth in the first quarter of 2023 met the Bank of Canada’s expectations, reaching an annualized rate of 3.1%.

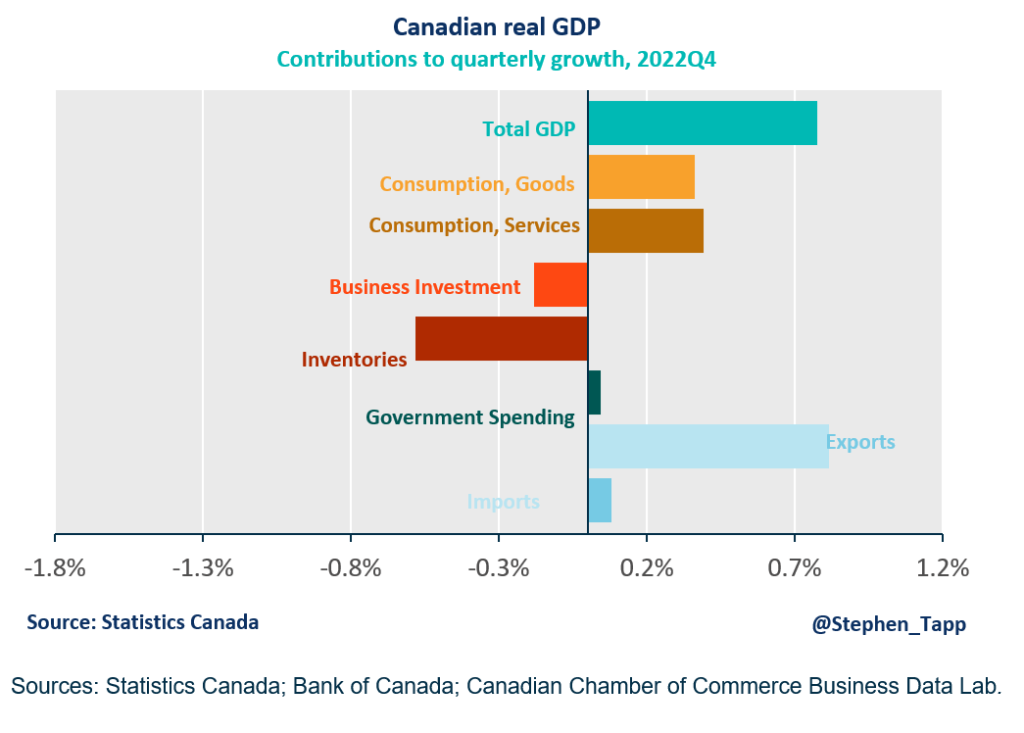

- The headline figure surpassed market expectations and the federal agency’s forecast of 2.5%, driven by a significant increase in final domestic demand (+0.7%). This is a notable improvement compared to the zero growth reported in Q4 2022. Additionally, StatsCan’s advanced estimate for April 2023 suggests a 0.2% growth, indicating a stronger start to Q2 than anticipated.

- The overheated economy proves it still has skin left in the game, with household spending rose for both goods (+1.5%) and services (+1.3%) after two lackluster quarters. However, the savings rate decreased from 5.8% in Q4 2022 to 2.9%.

Movers and Shakers

- Spending on durable goods, such as new trucks and sport utility vehicles, saw a significant increase (+3.3%), while semi-durables, like garments, experienced growth of 4.3%. Non-durables, on the other hand, saw a slight decline (-0.2%). In the services sector, growth was led by food and non-alcoholic beverage services, alcoholic beverage services (+4.4%), and travel expenditures by Canadians abroad (+6.8%).

- Favourable international trade contributed to overall growth, with exports of goods and services increasing by 2.4%, led by cars and light trucks. Imports also saw a modest uptick (+0.2%).

- There is evidence that interest rate adjustments are having an impact, albeit gradually. Residential investment experienced a significant decline for the third consecutive quarter (-14.6%).

- Business investment also weakened (-2.5%) for another quarter, partly due to lower inventories, which experienced the smallest change since Q4 2021, putting some downward pressure on GDP growth.

SENTIMENT, OUTLOOK & IMPLICATIONS

Outlook Ahead/ Recession Pulse

- Despite the Bank of Canada’s forecast of a 2.3% GDP increase this quarter, unexpected inflationary pressures in April and a persistently tight labor market with near-record-low unemployment indicate that a few key factors remain unchanged: it will require time, and this stronger-than-expected economy is not yet free from the potential of another interest rate hike.

SUMMARY TABLE

CHARTS

Other Commentaries

Apr 28, 2023

April 2023 Canadian GDP: Is this the calm before the storm?

Jan 16, 2024

CPI December 2023: Hovering above target, the new year will bring the same challenges in the battle against inflation

Sep 20, 2022