Commentaries /

April 2023 CPI: It’s all about that base!

April 2023 CPI: It’s all about that base!

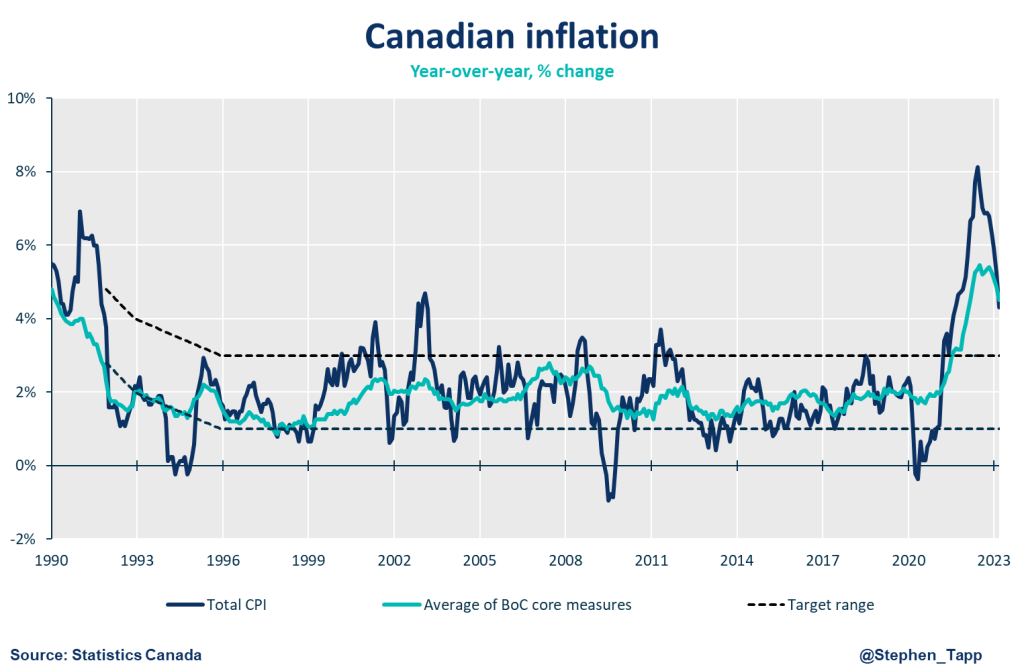

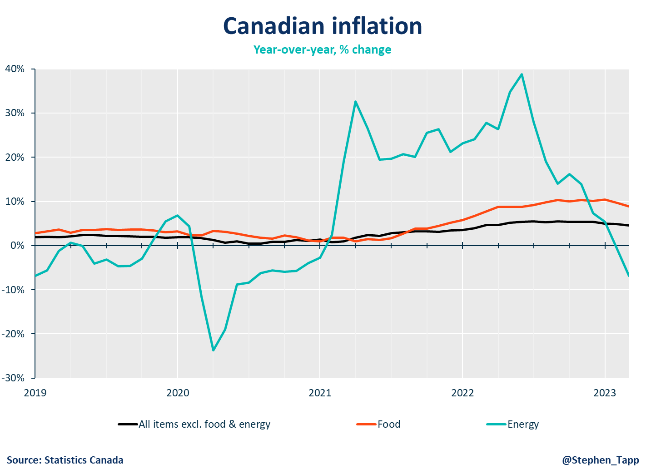

Canada’s inflation edged down for eighth consecutive month in March to 4.3%- the lowest headline since August 2021. While this report at face value is the kind of Spring green shoots that we’ve been anxiously awaiting, this sharp decline is led by falling energy prices and base effects from March of last year when the Russian invasion of Ukraine sent oil prices soaring.

Rewa

Canada’s inflation edged down for the eighth consecutive month in March to 4.3%- the lowest headline since August 2021. While this report at face value is the kind of Spring green shoots that we’ve been anxiously awaiting, this sharp decline is led by falling energy prices and base effects from March of last year when the Russian invasion of Ukraine sent oil prices soaring.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

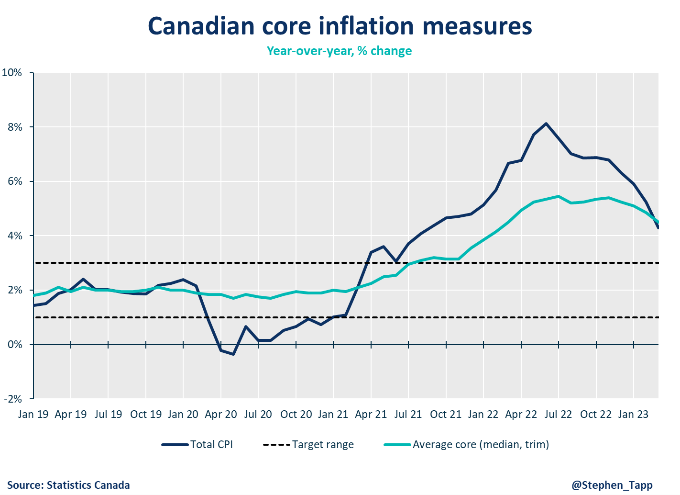

The broad-based price declines needed are still not here, but there is welcomed and needed reprieve for Canadian businesses and consumers in March’s report, as the pace of price growth is settling down. With its announcement last week, the Bank of Canada is holding the line on further increases for the overnight rate, and it’s clear their strategy is paying off, and inflation is moving along their expectations to decelerate to 3% by Q2 2023.

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation geared down to 4.3% year-over-year. This was the lowest headline since August 2021 and a sharp contrast from the 8.1% last summer. The slowdown in headline inflation was in line with market expectations.

- On a month-over-month basis, the CPI rose by 0.5% in March (compared to the 0.4% increase in February) and was even slower on a seasonally adjusted basis (0.1%).

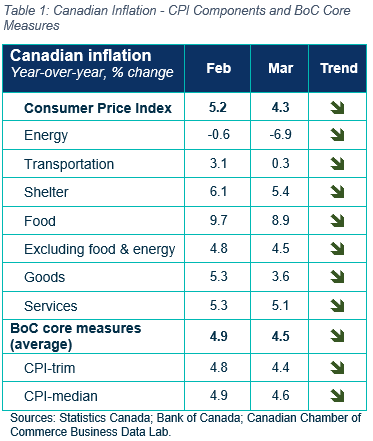

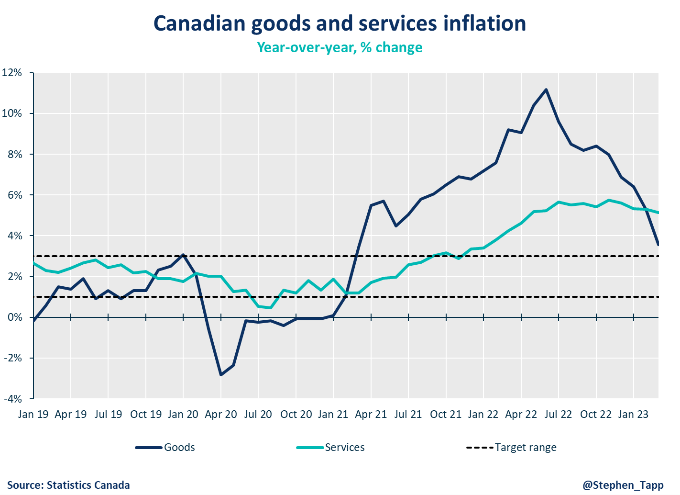

- The spread of inflation is narrowing across goods and services. Price increases for goods sharply slowed (to 3.6% from 5.3% in February). Those in services also edged down modestly (to 5.1% from 5.3% a month prior). Still, more than half of the categories in the CPI basket are still seeing inflation above the BoC’s 1% to 3% target range.

- In March, energy price growth slowed (to 4.5% from 4.8% in February). Gasoline prices continue to be a strong contributor to driving down inflation with a 14% decline in March. This, however, reflects base-year effects from when gasoline rose 12% month over month because of supply uncertainty a year prior when Russia invaded Ukraine.

CPI Components

- Food prices are still running hot (+8.9% yr/yr in March as compared to +9.7% February). As visits to the grocery store are still eating into consumer’s pockets, this welcomed slowdown comes by way of lower produce prices for fresh fruit and vegetables.

- Shelter costs rose 5.4% yr/yr, up by 0.4% from last month. Mortgage interest costs surged 26% in March – the largest yearly increase on record!

- Another noteworthy aspect of this month’s data is that the annual inflation rate was weaker than the growth in average hourly wages (5.3%). This is only the second month that wage growth exceeded inflation in the last two years.

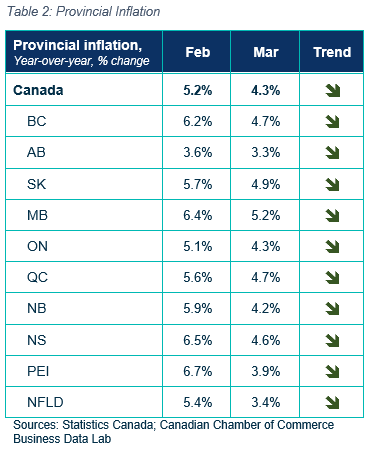

Provincial Inflation

- Another bright spot in the monthly report is that inflation slowed in all 10 provinces. Atlantic provinces New Brunswick (4.2%), Nova Scotia (4.6%), Prince Edward Island (3.9%) and Newfoundland and Labrador (3.4%) saw inflation slow the most.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

- The BoC’s two “core inflation” measures continued to soften – to 4.5% vs. 4.9% in February. Progress in these measures is mission critical to declaring victory in the fight against inflation.

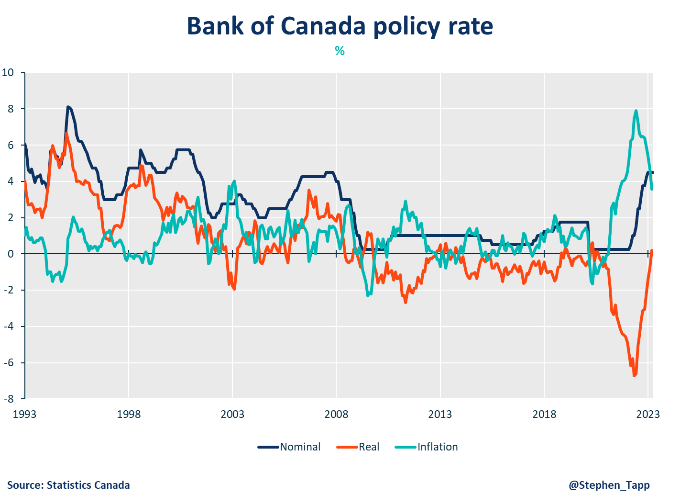

- A significant development since the early pandemic is that inflation is below the Bank’s nominal policy rate, which means that the real policy rate is now in positive territory, finally shifting to encouraging saving over spending.

- Shorter-term (three-month) core inflation measures slowed to the low-3% range on an annualized basis. This is a positive development but remains above the top of the BoC’s inflation control band, suggesting it may be difficult to quickly get inflation back all the way to 2%.

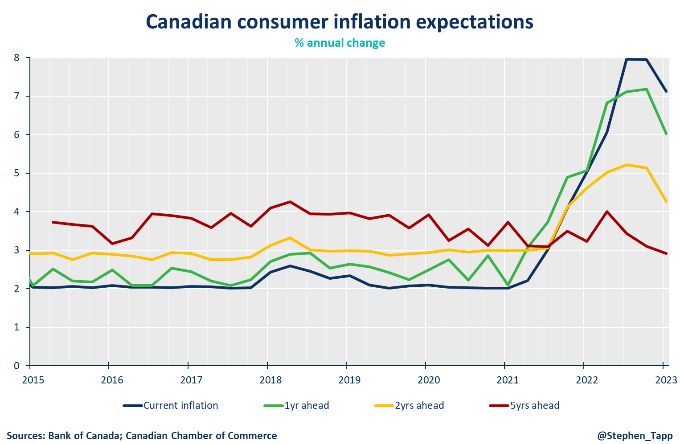

Inflation Expectations

- I am optimistic that, alongside the positive base effects and BoC’s continued quantitative tightening that the headline inflation will continue to decelerate in the coming months.

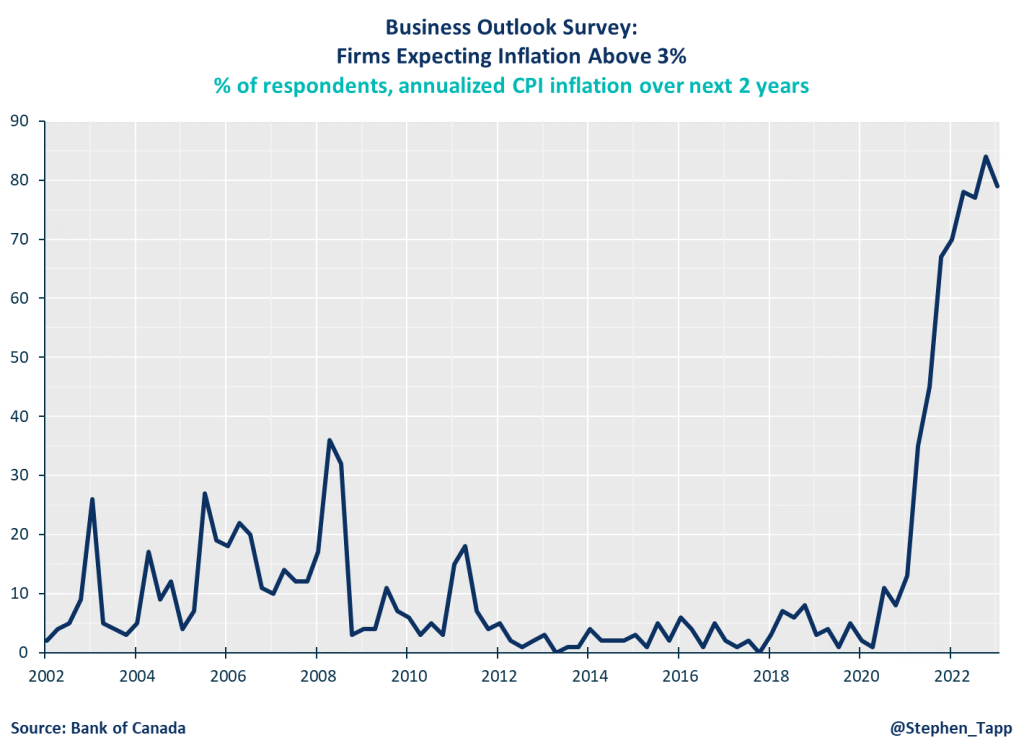

- On the real-economy side, according to the BoC’s most recent surveys business and consumer inflation expectations are moderating, but the possibility of a recession continues to weigh on their economic outlooks.

- For small businesses, a key question is: to what extent will higher interest rates and slowing consumer spending weigh on business sales growth? This is particularly the case for homeowners that are renewing home loans now at higher rates.

- Canadian firms’ expectations for high inflation are also shaping their price setting, which in turn, may be keeping some underlying momentum in price growth.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Sep 08, 2023

August 2023 LFS: No white flags for Canada’s job market as momentum remains strong.

Jan 17, 2023

December 2022 CPI: Start the new year with some good news

Mar 10, 2023