Commentaries /

April 2023 Canadian GDP: Is this the calm before the storm?

April 2023 Canadian GDP: Is this the calm before the storm?

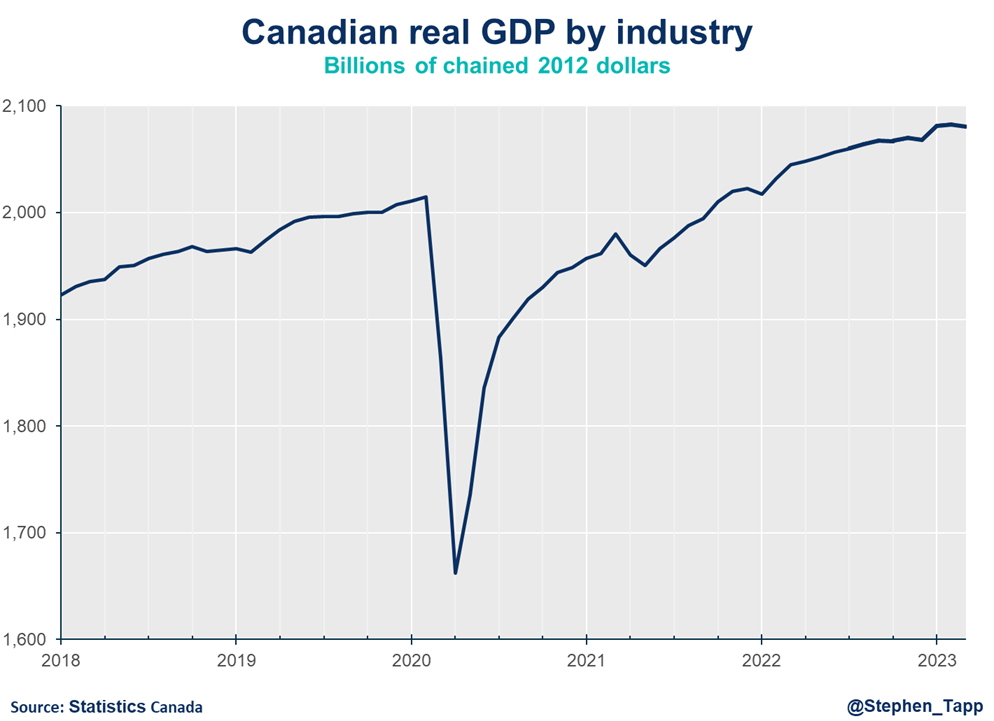

After a strong start to the year, Canada’s economic growth slowed in February, and likely turned negative in March. Economic momentum is clearly slowing — both in Canada and abroad — as the accumulating impacts of higher interest rates continue to take hold.

Stephen Tapp

After a strong start to the year, Canada’s economic growth slowed in February, and likely turned negative in March. I still expect a decent headline result for Q1 (with roughly 2% growth annualized), but the warning signs for Q2 are piling up. Economic momentum is clearly slowing — both in Canada and abroad — as the accumulating impacts of higher interest rates continue to take hold.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

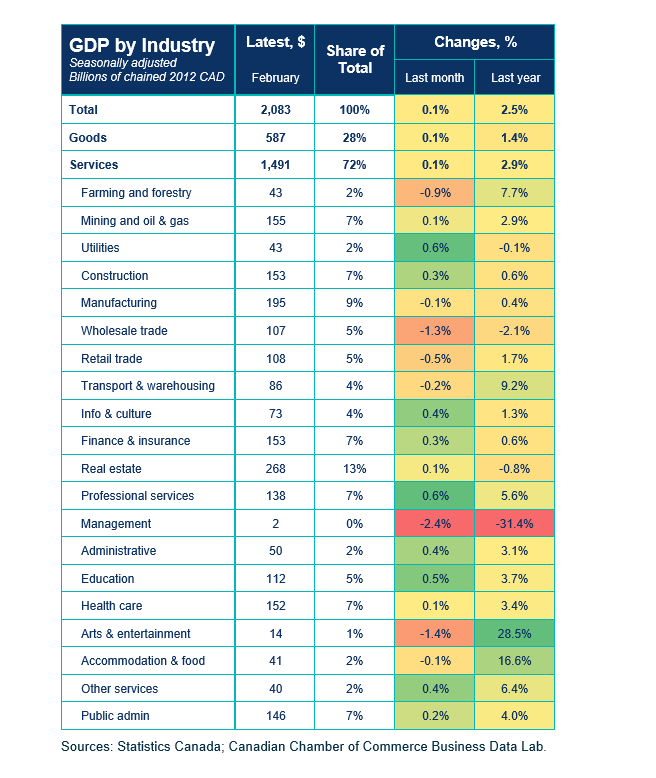

- After strong growth of 0.6% to start the year in January, Canada’s real GDP growth slowed to 0.1% in February. Markets expected a slightly better result (0.2%, after an advanced estimate of 0.3%).

- StatCan’s advanced estimate for March has GDP falling 0.1%. This is not good news, however, Canada’s economy is still on pace to record decent headline growth of roughly 2.5% for the first quarter.

Movers and Shakers

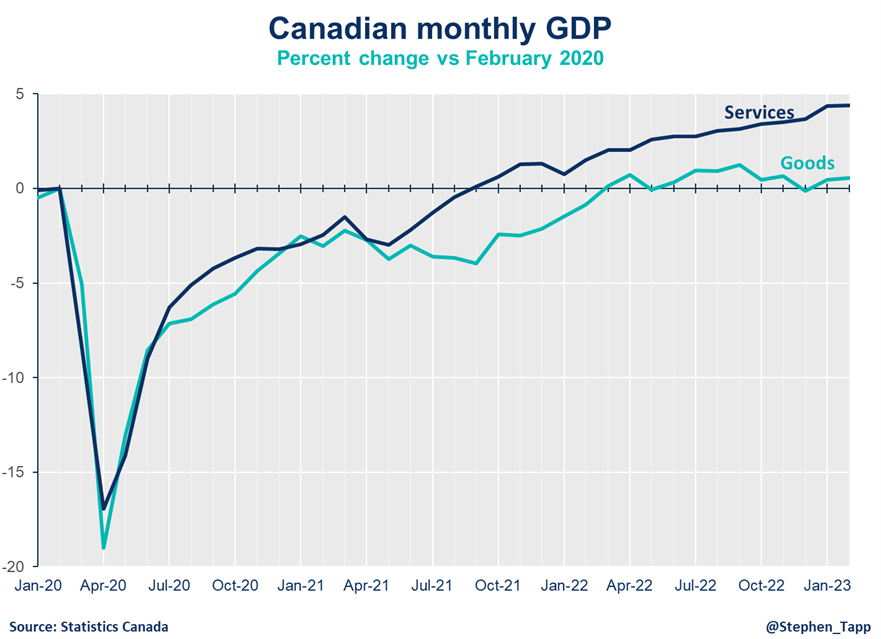

- Output grew in 12 of 20 sectors. Both services and goods sectors were up by 0.1%, while goods sectors have had a tougher time since last fall.

- Professional services (+0.6% monthly growth)continue to lead the economy.

- The resilience in construction (+0.3%, up for a second straight month) is impressive, given the large increase in interest rates over the past year. Perhaps pricing in Canada’s housing market has already hit bottom, given on-going supply challenges and strong demand expected from large increases in immigration in recent months.

- The public sector grew by 0.2%, and has grown for 13 months in a row. The federal public servant strike will be a drag on output starting in April.

- Wholesale (-1.3%) and retail trade (-0.5%) were weak, dragged down by autos and gas station sales.

Implications

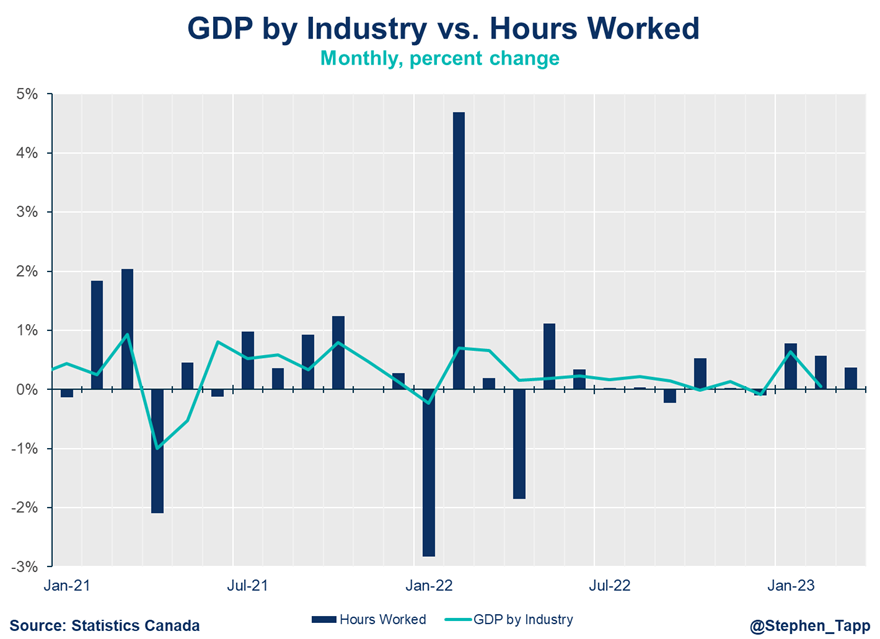

- The chances of a “soft landing” had increased in recent months, after very strong data for January, and containment of financial market stress, but the warning signs are piling up. Yesterday’s U.S. GDP growth miss for Q1 (1.1% annualized vs. 2.0% expected) may be a sign of what’s to come in Canada in Q2.

- The Bank of Canada’s latest forecast has growth of 2.3% for Q1, slowing to 1.0% in Q2. Alternatively, the Federal Budget — which was based on a private sector forecast average from February — had modest negative growth in the first three quarters of this year.

SUMMARY TABLE

CHARTS

Other Commentaries

commentaries

Jul 07, 2023

June 2023 LFS: Canada’s job market is turning a corner for the first time in a year

Canada’s labour market is turning a corner with June’s data. Coming in at the highest level in over a year, Canada’s unemployment rate edged up to 5.4%.

commentaries

Feb 29, 2024

Q4 2023 GDP: Pretty good news as the economy holds footing

Canada’s economy navigated through a potential rough spot in the fourth quarter, with help from exports and consumer spending on autos, as supply chain backlogs continued to ease.

commentaries

Sep 29, 2022

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Marwa Abdou, our Senior Research Director, evaluates Canada’s real GDP in July, which increased 0.1%.