Commentaries /

May 2023 CPI: Canada’s inflation surprisingly edges up, breaking its chilly streak

May 2023 CPI: Canada’s inflation surprisingly edges up, breaking its chilly streak

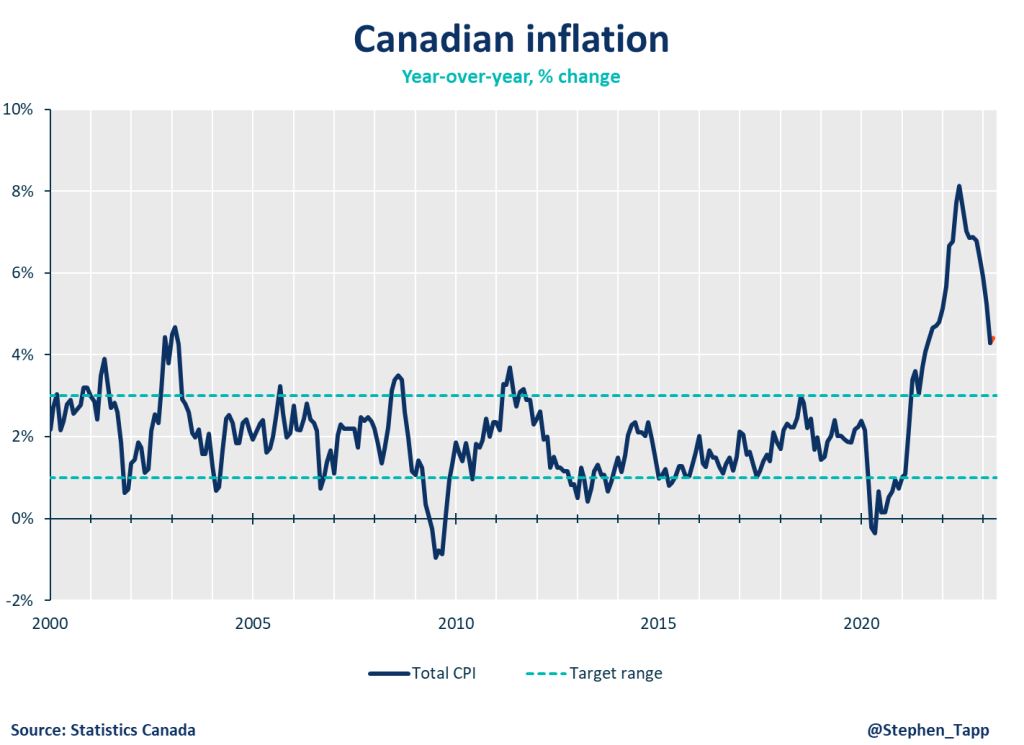

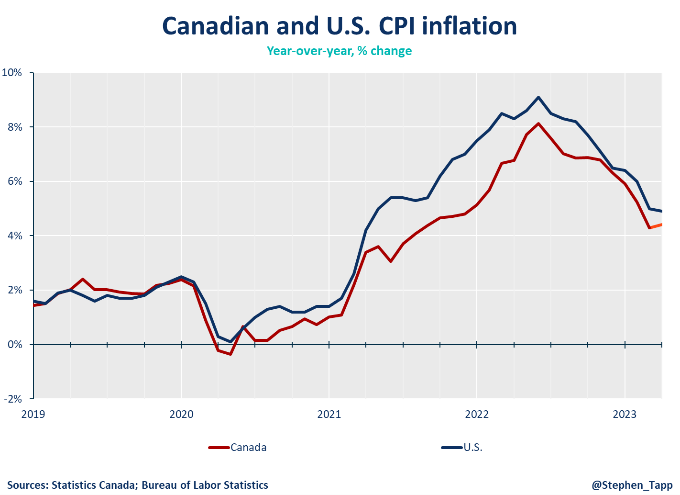

Breaking an 8-month streak of cooling, Canada’s headline inflation edged up to 4.4%. This was higher than market expectations which predicted another drop from March’s 4.3%.

Marwa Abdou

Breaking an 8-month streak of cooling, Canada’s headline inflation edged up to 4.4%. This was higher than market expectations which predicted another drop from March’s 4.3%. The acceleration in this report came by way of an increase in gas prices, rent and mortgage interest rate costs. As it continues to hold its policy rate at 4.5%, this surprising report will keep the Bank of Canada on greater alert, as we await its next announcement in early June.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation edged up to 4.4% year-over-year in April. This broke an almost three-quarter streak of cooling down from headline peak 8.1% last summer. The slowdown in headline inflation was well above market expectations (4.1%).

- On a month-over-month basis, the CPI rose by 0.7% in April (compared to the 0.5% increase in March).

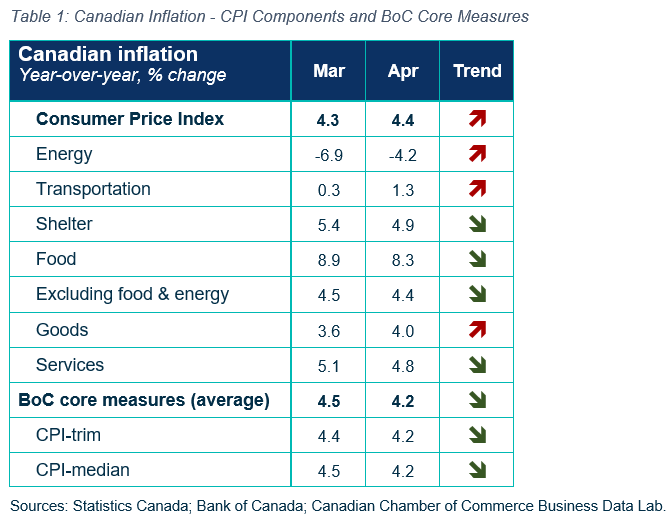

CPI Components

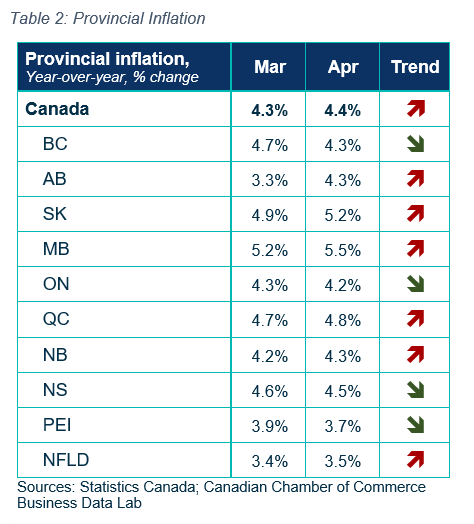

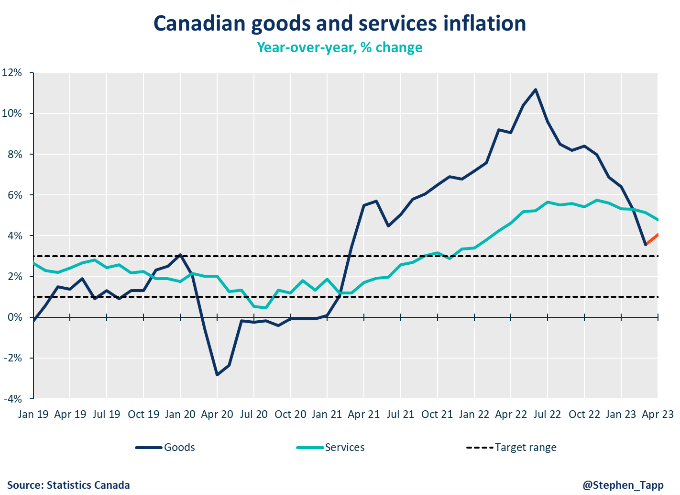

- One bright spot in this report is that the spread of inflation continues to narrow across goods and services. Price increases for goods rose to 4.0% in April from 3.6% in March, whereas those in services declined to 4.8% from 5.1% a month prior. Still, it’s important to note that all but transportation prices (1.3% up from 0.3%) in the CPI basket are seeing inflation above the BoC’s 1% to 3% target range.

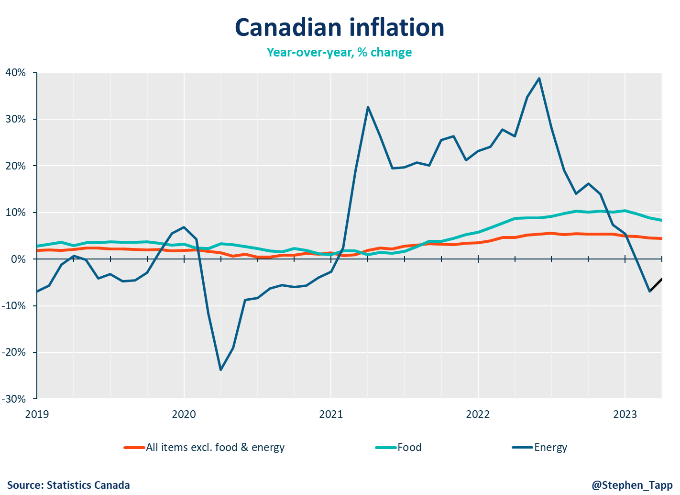

- Another glimmer of light is that grocery (+9.1% yr/yr from 9.7% in March) and food prices (8.3% from +8.9% March) have finally started to loosen their grip on consumers’ wallets.

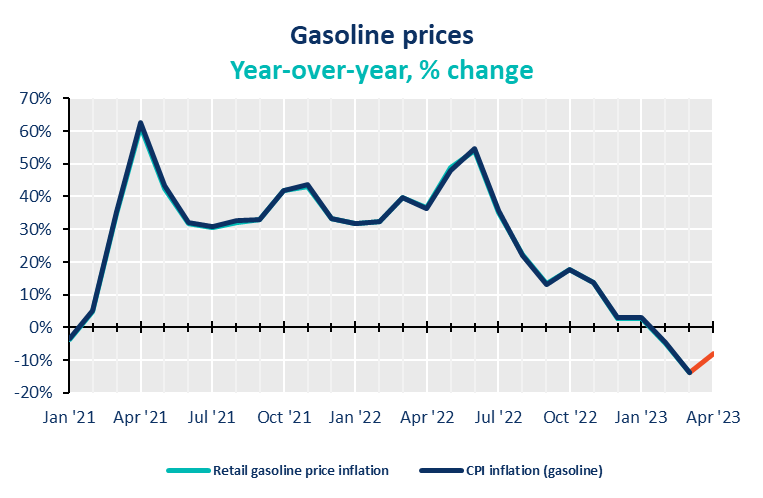

- The largest contributor to the acceleration of this month’s headline number, gasoline rose prices in April by 6.3% – the largest m/m increase since October 2022. This surge in prices followed OPEC+’s April announcement representing the largest cut since the start of the pandemic and equivalent to 2% of global oil demand.

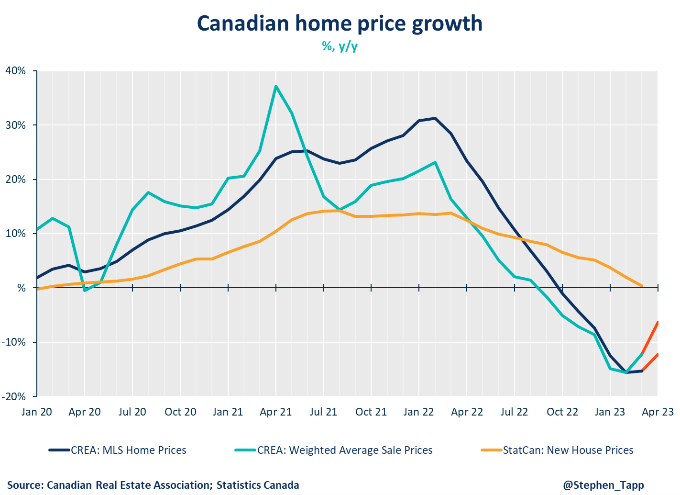

- While mortgage costs were up by almost 29% yr/yr from April 2022, Canadians are seeing shelter costs decelerate a little – 4.9% yr/yr from 5.4% from last month.

- Average hourly wages are still heating up past annual inflation rate at 5.2% in April. Wage growth has exceeded inflation over the past quarter – a pattern we’ve been avoiding for two years but something that will keep analysts watching for a wage-price spiral.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

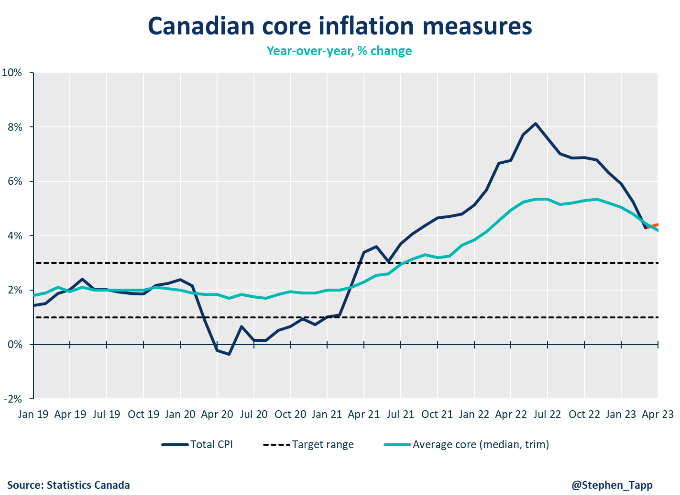

- If there is another positive glimmer in healing an additional policy rate hike in early June, it’s that we saw the BoC’s two “core inflation” measures continue to soften to 4.2% vs. 4.5% in March. Progress in these measures remains mission critical to declaring victory in the fight against inflation.

- The Bank expects inflation to dramatically step down to the 3% target range next month. That said, with shorter-term (three-month annualized) core inflation still running above 3.5%, the Bank will be thinking hard about whether additional rate hike(s) are needed to fully bring inflation under control.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

commentaries

Mar 19, 2024

February 2024 CPI: The Bank of Canada will crack a smile with more good news on inflation

Canada’s headline CPI inflation grew 2.8% in February. What does it mean for the economy?

commentaries

Sep 06, 2023

Sputtering economy puts the Bank of Canada on pause

While the Bank held its fire, we should consider this a “hawkish hold,” emphasizing that it will raise interest rates...

commentaries

Feb 09, 2024

LFS January 2024: A warmer start to the year than anticipated but winter is still coming

Following a flat streak in the last quarter of 2023, Canada’s labour market kicked off the new year a little better than expected.